“Data Dependent Fed” Ignores Data

I wrote on Tuesday of this week:

“The Fed currently finds itself in a tough spot from a “data dependent” standpoint. Last December, when the Fed Funds rate was increased, the Fed discussed the potential for further rate hikes in 2016 as inflation and employment data strengthened. With that data improving, along with the strong rebound in the financial markets, the Fed runs the risk of losing credibility if they DO NOT hike rates again on Wednesday OR give a very strong indication they will do so at the next meeting.”

“My personal take is that the Fed will likely NOT hike rates tomorrow, however, stronger language about further rate hikes this year will be included.

The question is whether the market likes the outlook for stronger economic growth more than a further reduction in monetary accommodation?”

Given the “data” the Federal Reserve is supposed to be looking at, I have to admit I was more than a bit stunned by the lack of action given the more “hawkish” revisions to the Fed’s statement.

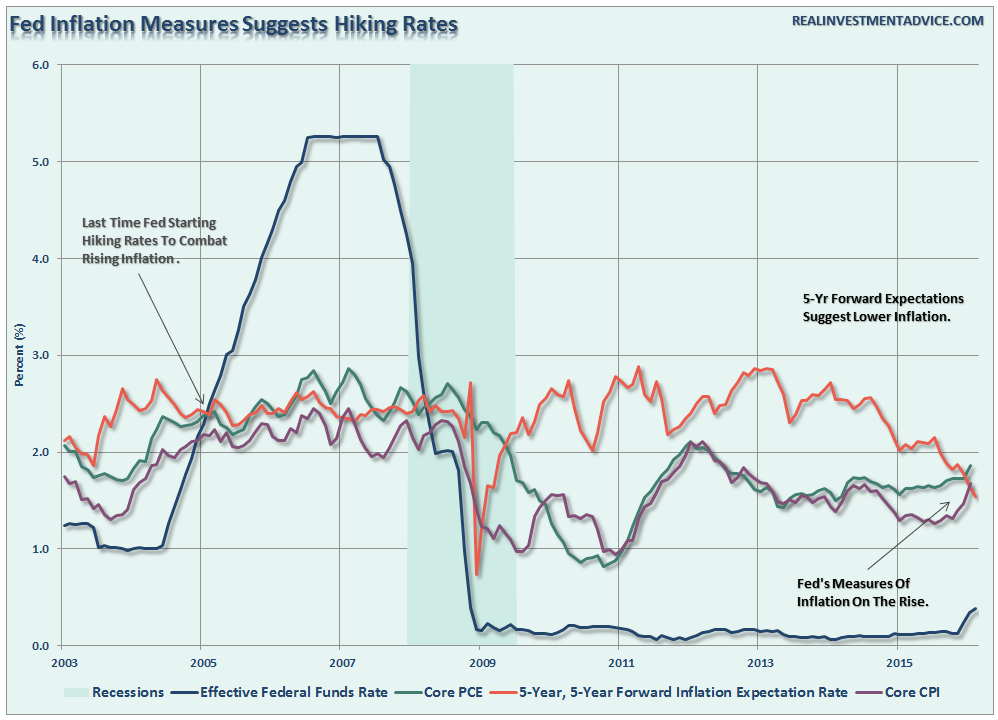

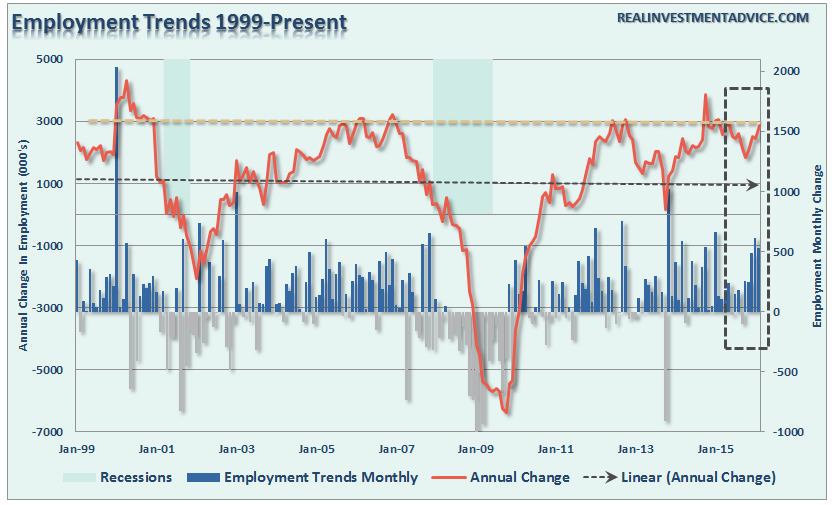

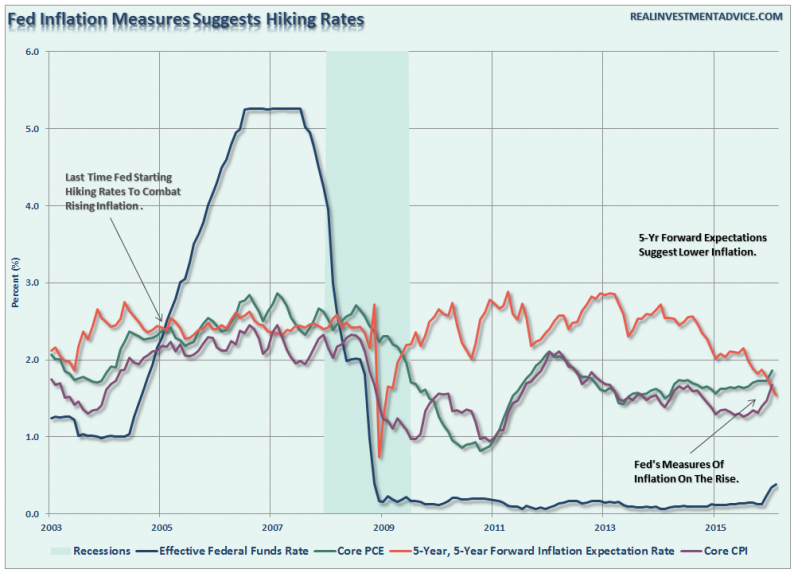

The Fed noted that economic strength had expanded in recent months, household spending has picked up and housing had improved further. Employment gains remained strong and indicators point to further job gains ahead. Inflation had also picked up but continues to run below the Fed’s 2.0% target level. All of this suggests that the Fed should have hiked rates at this meeting. However, it was ongoing global risk that kept them at bay

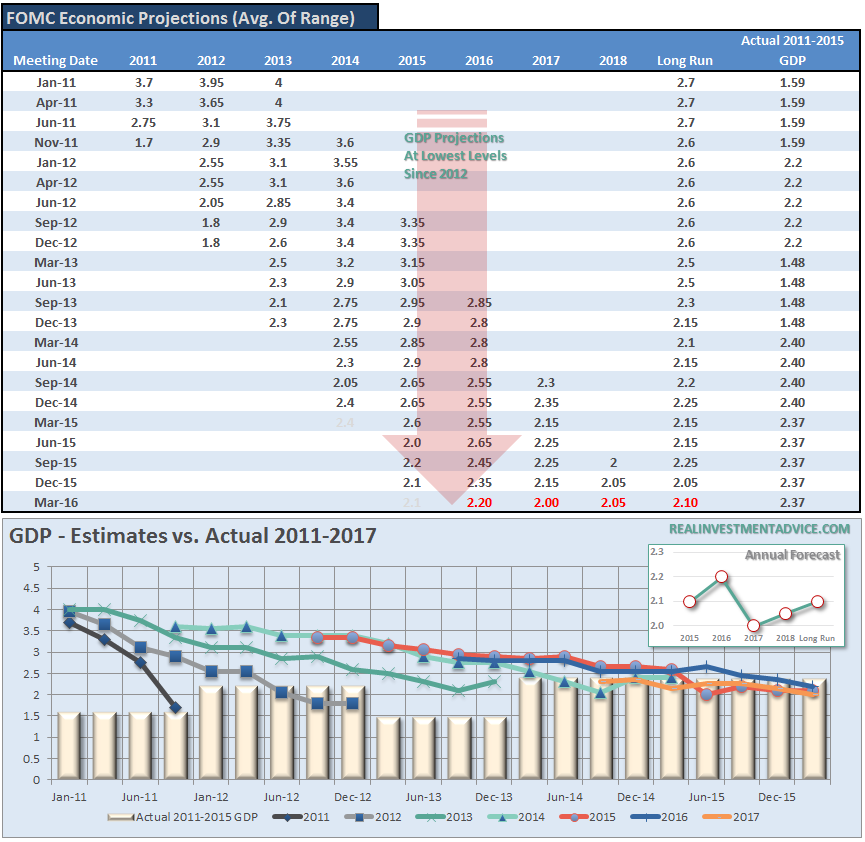

But was it really just “global risk?” The answer was found in the Fed’s “forward guidance,” as their projections explained why they didn’t increase rates. As shown in the chart below, once again the Fed lowered expectations further for economic growth and reduced the number of rate hikes this year from 4 to 2. Yep, “accommodative policy” is here to stay for a while longer which lifted stocks yesterday’s close.

Besides being absolutely the worst economic forecasters on the planet, the Fed’s real problem is contained within the table and chart above. Despite the rhetoric of stronger employment and economic growth – plunging imports and exports, falling corporate profits, collapsing manufacturing and falling wages all suggest the economy is in no shape to withstand tighter monetary policy at this juncture.

Leave A Comment