Another View On The Inflation Argument

There is little evidence that current levels of inflation are stable. As I wrote in “Inflation: The Good & The Bad”, outside of just two areas, rent and health care, there remains a broader deflationary trend currently.

Importantly, as I noted, there are two types of inflation:

“Inflationary pressures can be representative of expanding economic strength if it is reflected in the stronger pricing of both imports and exports. Such increases in prices would suggest stronger consumptive demand, which is 2/3rds of economic growth, and increases in wages allowing for absorption of higher prices.

That would be the good.

The bad would be inflationary pressures in areas which are direct expenses to the household. Such increases curtail consumptive demand, which negatively impacts pricing pressure, by diverting consumer cash flows into non-productive goods or services.”

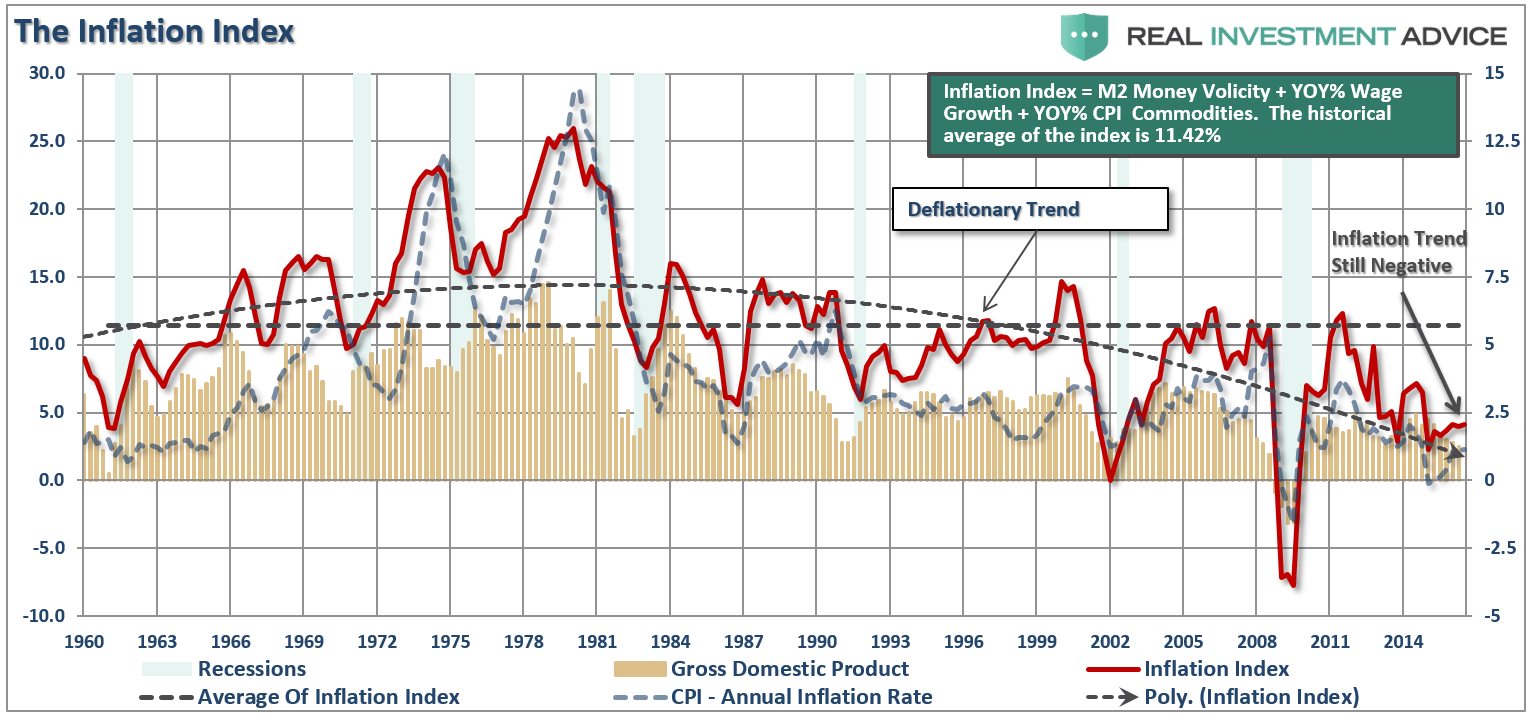

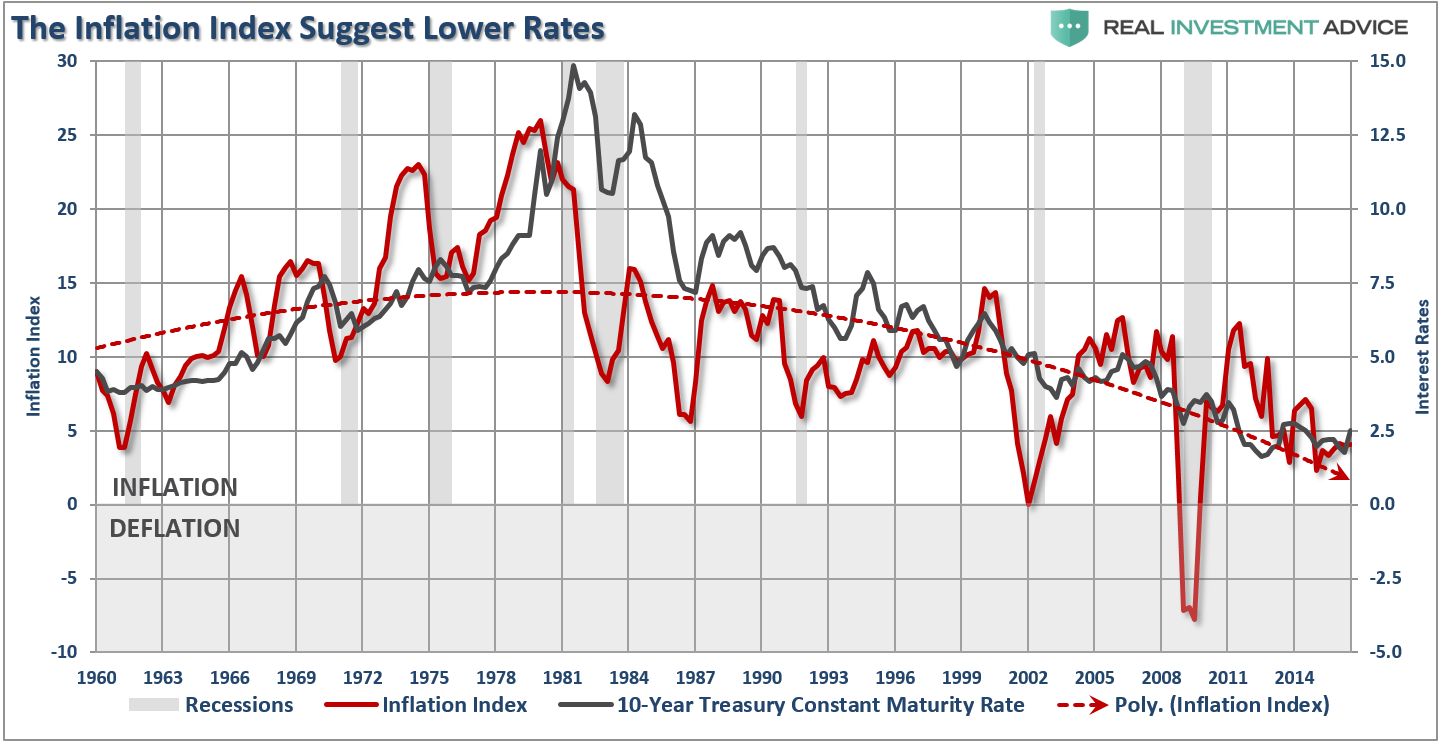

There is another way to view whether the “good” inflation is manifesting itself within the economy. The chart below shows the three major components that input into creating economically viable inflation – commodity prices (which reflects real economic activity,) wages (which allow for increases in spending and support for higher prices,) and the Velocity Of Money (which shows the demand for money through the economic system.)

When we combined these three components into a composite inflation index, and compare it to CPI, we find an important outcome.

Currently, there are relatively few “real” inflationary pressures in the economy particularly as monetary velocity continues to plummet. It is also notable that both CPI and the inflation index remain below 2.5% even as interest rates push that level. Ultimately, either inflation will rear its head, or rates will drop back in line with the historic norms of real inflation levels and economic growth.

There is little argument over the fact that the current economic growth rate has been “sluggish” at best. Growth in the financial markets has been primarily a function of the Federal Reserve’s ongoing balance sheet expansion as economic activity remains fairly subdued. With the Federal Reserve now increasing interest rates over concerns about rising inflationary pressures, the Fed may once again be making the same mistake as they did in 1999. To wit:

“If this market rally seems eerily familiar, it’s because it is. If fact, the backdrop of the rally reminds me much of what was happening in 1999.

1999

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth was improving

- Interest and inflation were rising

- Earnings were rising through the use of “new metrics,” share buybacks and an M&A spree. (Who can forget the market greats of Enron, Worldcom & Global Crossing)

- The stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

If you were around then, you will remember.

With Yellen, and the Fed, once again chasing an imaginary inflation ‘boogeyman’ (inflation is currently lower than any pre-recessionary period since the 1970’s) the tightening of monetary policy, with already weak economic growth, may once again prove problematic.”

Leave A Comment