Before we discuss the basic of options parameters for trading, we need to understand the concept of volatility. This is not simply an observational number, thought it can be used as such. In general stock investors want to avoid volatility. They want to minimize the standard deviation of their investments, as large drawdowns can be petrifying to some. This is a reaction that encompasses more than trader psychology; when the broker taps you on the shoulder with his margin call, it really is game over for you. This can be unfair, but those with the gold set the rules.

However volatility is much much more than an indicator of deviation of price. Inherently, volatility mean reverts. Specifically, when we look at the volatility of an instrument over a fixed length of time, say one year, the relative highs of the year, and relative lows of the year can be identified. They usually (though not always) revert back down to the mean. This is an edge that be utilized. More on this later.

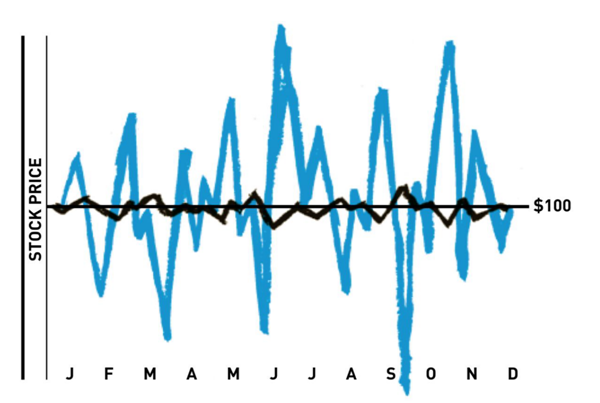

Let’s define the precise numbers we need to look at. Historical volatility is simply the volatility of an instrument in the past. It’s also known as the “annualized standard deviation” of an instrument’s price. In the first figure below, the black line shows the changes in price over time of a low volatility instrument while the blue curve shows the volatility of an instrument with relatively high volatility.

(C/o “The Options Playbook, by Brian Overby, used with permission)

Now to the more interesting part. We can estimate the current volatility of a stock or instrument through the value of its options. In a future article we will explain how options and stock are interchangeable, but for now, I emphasize the point that we can derive an implied volatility of an instrument through the price of the options on that instrument. Why does this matter? Implied volatility is different from historical volatility because the former looks to the future while the latter looks into the past. In fact, the implied volatility is probably one of the most intriguing pieces of data, because it can reveal truths about a company well before such truths are widely known.

Leave A Comment