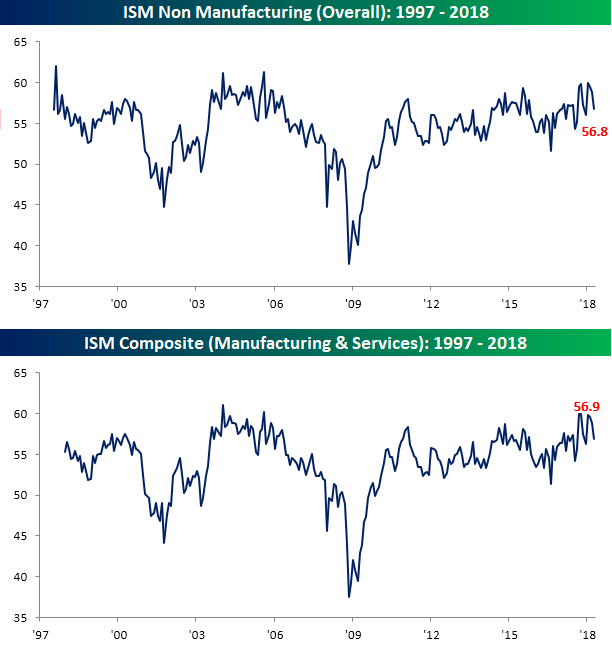

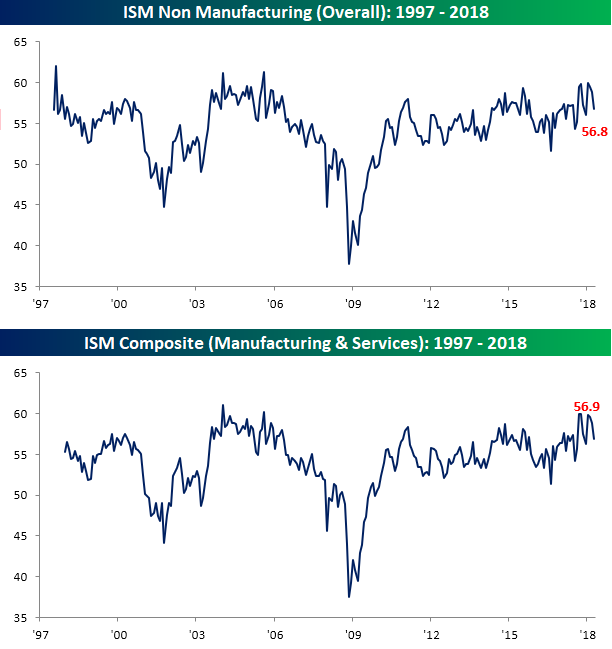

Just like its counterpart that covers the Manufacturing sector, the ISM Services report for April declined this month and came in lower than expected. While economists were expecting the headline index to come in at a level of 58.0, the actual reading was notably weaker at 56.8. While both indices have declined, the magnitude of the drop in the Services sector hasn’t been quite as large.

On a combined basis and accounting for each sector’s share of the overall economy, our composite ISM for April came in at 56.9, which is pretty much in the range of levels we have seen over the last few months. The general takeaway from these reports is the same as we have seen in much of the recent economic data — upside momentum has slowed, but from levels that were very positive to begin with.

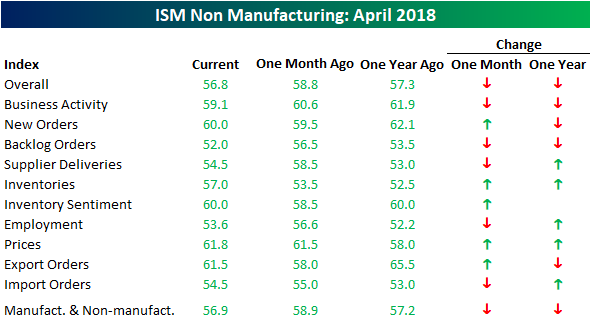

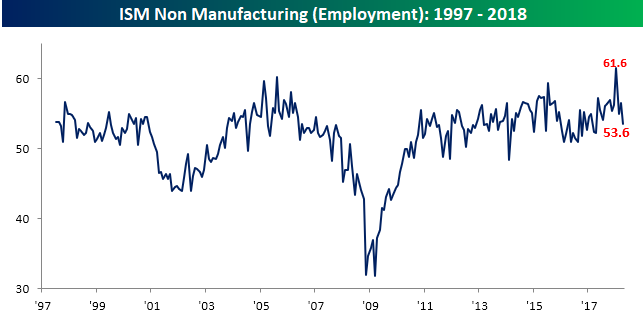

The table below breaks down this month’s report by each of its individual components. Breadth in this month’s report was pretty much neutral on both a m/m and y/y basis. The increases relative to March readings were Inventories and Export Orders, while Backlog Orders and Supplier Deliveries saw the largest declines. Given the fact that the March Non-Farm Payrolls report will be released on Friday, we would also note that the Employment component saw a pretty large drop this month and is down sharply from its recent peak in January (chart below).

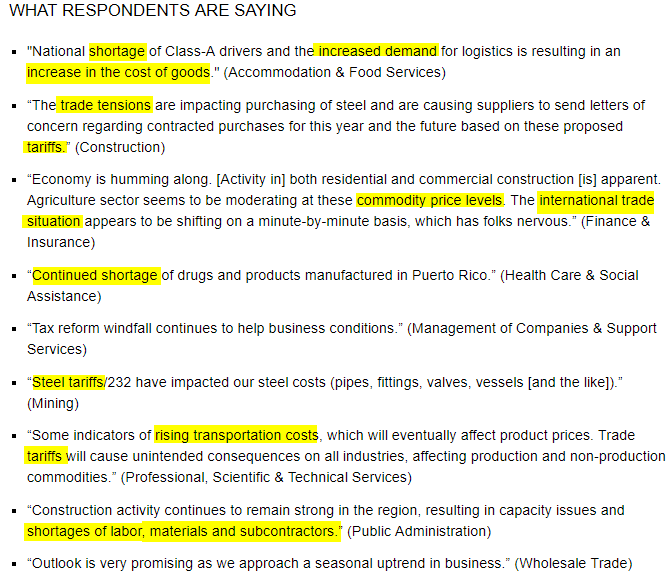

Finally, with all the concerns regarding inflation, we would note that like the counterpart in the ISM Manufacturing report, the commentary in the ISM Services report also made many mentions of factors that are having upward pressure on prices. Issues like shortages, strong demand, trade tensions, and rising costs are all ultimately inflationary even if the details of this month’s report like the Prices Paid component didn’t see large increases.

Leave A Comment