Are you ready? October was a rough month for stocks. In fact, US markets lost nearly $2 trillion, with tech large-caps some of the worst hit. So will this turbulence roll over into November? The jury is out. But even within these choppy markets some key stocks still stand out. Top analysts say these 4 ‘Strong Buy’ stocks are looking as compelling as ever as we head into November. We pinpointed these stocks using TipRanks stock screener. This enables you to screen for stocks with a killer ‘Strong Buy’ consensus from the Street’s best-performing analysts. Let’s dive in to four top stocks now. As you will see, three out of these four stocks even boast 100% Street support based on ratings from the last three months:

1. Microsoft

Microsoft Corporation (MSFT – Research Report) is on a roll right now, crushing Street estimates with extremely robust 1Q19 results. This includes a $1.2B revenue beat and an equally impressive $0.18 EPS beat.

Think about this: 1Q19 revenue increased 18.5% y/y to $29.1B. We are now looking the fifth consecutive quarter of double-digit growth for the largest software franchise in the world.

“We would continue to Overweight MSFT shares on a multiyear model transformation driven by fast-growing cloud and internet segments that we estimate could top $70B in revenue by CY20 vs. $18.5B in CY16” says KeyBanc’s Brent Bracelin (Track Record & Ratings).

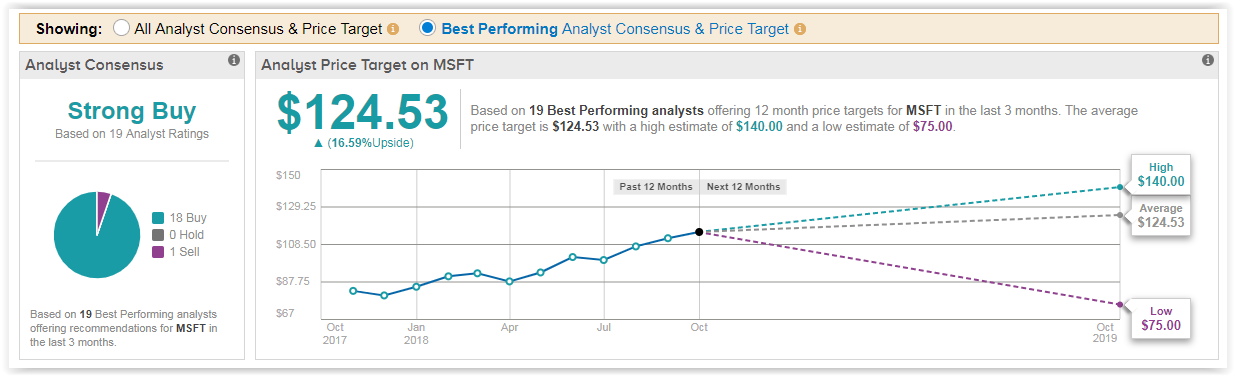

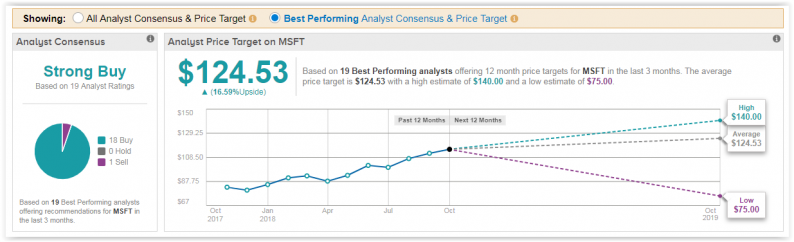

Bear in mind this analyst falls in the Top 25 out of over 4,800 analysts ranked by TipRanks. In other words, he knows what he’s doing. Bracelin sees prices surging 22% to $125. This is up from $123 previously.

Overall, 15 out of 16 top analysts have published Buy ratings on MSFT in the last three months. Their average price target stands at $123 (20% upside potential).

View MSFT Price Target & Analyst Ratings Detail

2. Gray Television

If you are looking for a lower-priced stock that still packs a big punch, look no further. Gray Television (GTN – Research Report) has received 3 recent buy ratings — all from top analysts. These analysts (on average) see prices surging from $16.60 to $23.67. In other words, this means upside potential of over 42%.

Leave A Comment