Photo Credit: Marc Levin

Walt Disney (DIS) Consumer Discretionary – Media | Reports February 7, After Market Closes

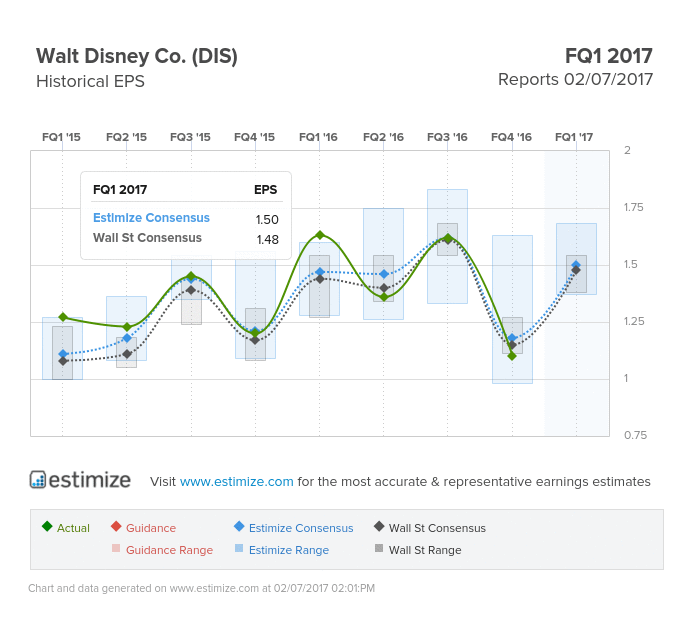

Disney prepares to kick off its fiscal 2017 when it releases first quarter results tomorrow after the market closes. The entertainment giant is coming off a disastrous fourth quarter that fell short of the Estimize consensus by 8 cents per share on the bottom line and about $400 million on the top. The report didn’t phase investors though, as share climbed about 19% in the past 3 months. Tomorrow’s results will yet again focus on the performance of ESPN but also highlight the success of the newest Star Wars movie released in mid December. It’s understandable that expectations for the first quarter remain tepid given the company’s share of ups and down last year.

Analysts at Estimize expect earnings to come in 1 cent higher than the Street at $1.50 per share, reflecting a 7% decline from a year earlier. That estimate fell by 5% following dismal fiscal fourth quarter results. Revenue for the period is forecasted to increase 1% to $15.30 billion on robust ticket sales from Star Wars Rogue One. Historically the stock doesn’t react immediately through the print but tends to move the most in 30 days prior and after a report.

As always ESPN subscription numbers fall front and center when Disney announces quarterly results. The multimedia sports network continues to face an uphill battle in light of cord cutting behaviors and wider adoption of skinny bundles. Operating income from Cable Networks decreased $207 million during Q4 due to decreases at ESPN and Disney Channel. Growth at Freeform (formerly ABC Family) helped offset some of these losses through lower programming and production costs, and a decrease in marketing expenses. Income from broadcasting, on the other hand, increased $60 million to $224 million, on greater program sales from shows such as Luke Cage and Quantico. However, the overall performance of media networks is still predicated on the performance of ESPN, which otherwise looks bleak.

Leave A Comment