After an ugly start to 2016, investors have become more interested in REITs. They are starting to realize that quality commercial real estate assets that generate attractive cash yields may be a stable place to invest as the more high-flying market sectors run into a global economic slowdown. The best REITs to own are those that provide regular dividend increases, growing your cash flow stream and pulling share prices higher.

Most REITs announce dividend increases once a year and in the same month each year. Across the sector, there are increase announcements in almost every month in the calendar. You can often get a nice share price gain by buying shares before a dividend increase announcement hits the news wires. I maintain a database that covers about 140 REITs. I use the database to track dividend rates, yields, and increases. Of the 140, about 95 have histories of regular dividend increases. There are five REITs that should announce a dividend increase in April.

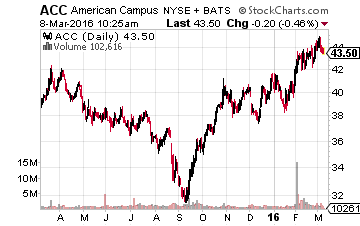

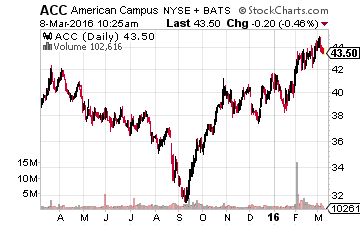

American Campus Communities, Inc. (NYSE: ACC) owns, manages, and develops primarily off-campus student housing properties in the United States. The company owns about 160 properties with almost 100,000 beds. While some growth comes from acquisitions or development, ACC also realizes 2.5% per year of average rental rate growth. Since resuming dividend increases in 2013, the payout has been increased by about 6% for three consecutive years. In 2015, FFO per share was flat compared to 2014. However, the current dividend is just 68% of FFO, so a moderate increase is still likely for this year. The new dividend rate is announced at the end of April/early May with an end of May payment date. ACC currently yields 3.7%.

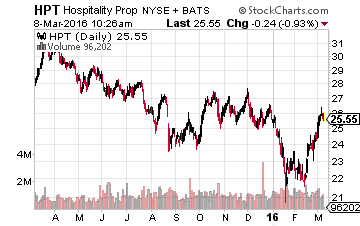

Hospitality Properties Trust (NYSE: HPT) owns 302 hotels and owns or leases 193 travel centers located throughout the United States, Canada, and Puerto Rico. All of the properties are leased to management operators. In 2015, FFO per share was up 1.5% over 2014. The current dividend rate is 60% of 2015’s FFO. For the last several years, HPT has been increasing the dividend by about 2% annually. The new dividend rate has been announced in mid-April, with a late April record date and second half of May payment date. HPT yields 7.7%.

Leave A Comment