(Photo Credit: Sergio Uceda)

Monday, December 14

Wednesday, December 16

Friday, December 18

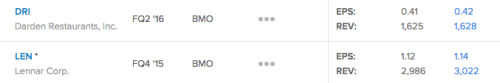

VeriFone Systems (PAY)

Information Technology – IT Services | Reports December 14, after the close.

The Estimize consensus calls for EPS of $0.49, just a penny higher than Wall Street and company issued guidance. The Estimize community is looking for sales of $516.9M, above the Street’s estimate for $513.4M and guidance of $511.5M.

What to watch: Verifone is the maker of electronic payment terminals, including Europay, Mastercard, Visa (EMV) systems which accept credit cards with chips. As of October 1, merchants using non-EMV compliant terminals began assuming liability for fraudulent transactions, a liability previously held by the credit card companies. The shift in this liability should be profitable for Verifone as merchants scramble to update their payment terminals (at last read in 2014, the percentage of EMV enabled devices only reached 27%). Gas stations get a two year extension, however. None of the more than 1 million gas stations in the US have EMV capable devices at this point, due to the high cost of updating self-service gas pumps. Also worth watching on Monday is progress in Near Field Communication (NFC) technology, which allows electronic devices to exchange radio communication with each other when brought into close proximity – technology used with such apps as Apple Pay, Android Pay and Google Wallet.

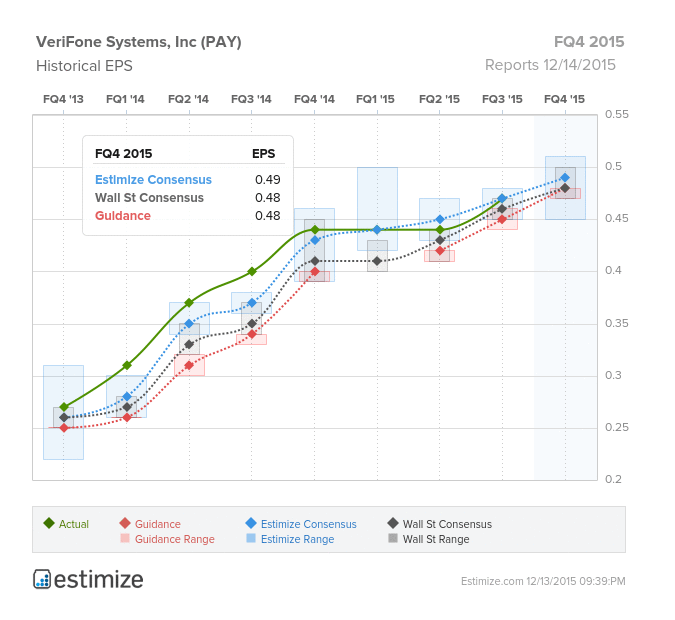

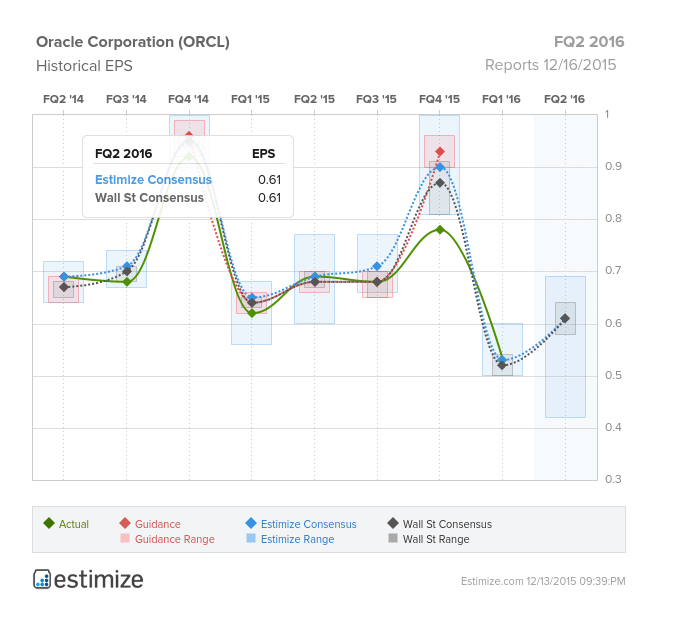

Oracle (ORCL)

Information Technology – Software | Reports December 16, after the close.

The Estimize consensus calls for EPS of $0.61, in-line with Wall Street. Revenue estimates are also quite close, with the Estimize community calling for $9.113B and the Street slightly lower at $9.094B.

What to watch: Cloud competitors have their eyes on Oracle as the company continues to rapidly build out its SaaS and PaaS product offerings. To put this in perspective, Oracle’s human capital management (HCM) SaaS product secured three times as many new customers as competitor Workday’s similar HCM product. This focus on the cloud has led Oracle to expect approximately $1.5-$2 billion in new SaaS and PaaS purchases this year alone. Oracle’s SaaS and PaaS revenues experienced a 54% increase last quarter as a result of the shift of 95% of its services to the cloud. While the cloud has been gaining traction, it hasn’t been enough to offset weakness in Oracle’s bread and butter software licensing division, which dropped 16% last quarter. For that reason, Oracle has not been able to beat analyst estimates on the bottom-line for the past eight quarters, missing in five of those quarters and meeting in the other three. Revenues have been even worse, missing expectations in six of the past eight quarters. Year-to-date the stock has dropped nearly 15%.

Leave A Comment