Tuesday, May 10

Thursday, May 12

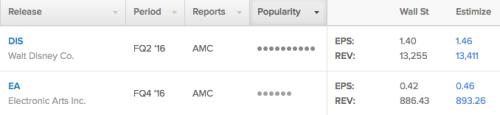

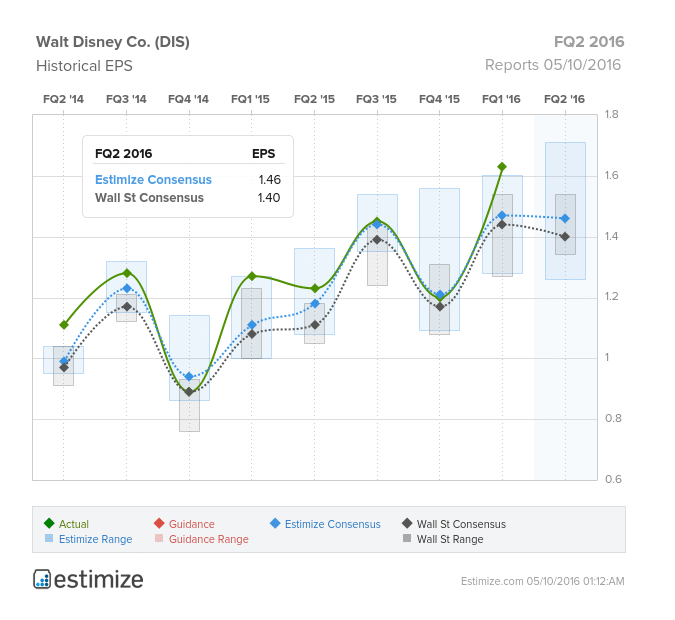

Disney (DIS) Consumer Discretionary – Media | Reports May 10, after the close.

The Estimize community calls for EPS of $1.46, six cents higher than Wall Street, while revenue estimates of $13.4B just above the sell-side’s $13.25B. The Estimize community has been slightly bullish on Disney’s profitability, moving EPS estimates up 4% since the FQ1 report, now expecting YoY growth of 18%. Revenue estimates have only been ratcheted up 1%, and are expected to grow 8% from the year-ago period. On average DIS has beaten on EPS 65% of the time, but only 47% on sales.

What to Watch:

Studio Entertainment: Disney is coming off a strong Q1 primarily driven by the success of Star Wars: The Force Awakens. The global success of the movie drove revenue growth at both Studio Entertainment and Consumer products which increased 86% and 23%, respectively. This quarter should continue to get a nice bump as the blockbuster was still going strong well into the beginning of 2016, plus the box office success of animated film, Zootopia, which currently stands as the top grossing movie of 2016, nearing $1 billion in ticket sales as of early May. Meanwhile, the newest Captain America movie released last Friday drew in $180 million in ticket sales for its opening weekend, a benefit that won’t be seen until next quarter.

Parks & Resorts: Lately parks and resorts have performed just as well as Disney’s studio entertainment. This sector saw revenue increased 9% and operating income climb 21% for Q1 2016. Higher operating income at domestic locations was due to higher average ticket prices and attendance growth. This more than offset the increases in labor costs and new guest offerings incurred in the quarter. With a Star Wars themed attraction set to launch soon, parks and resorts should continue to see stable growth.

Media Networks: Media networks, on the other hand, have been a sour spot for Disney lately. As cord cutting habits run rampant and programming costs continue to increase, cables networks suffer. Last quarter, Disney saw operating income fall 5% in this segment, due to a substantial decline from ESPN.

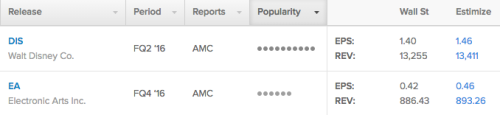

Electronic Arts (EA) Information Technology – Software | Reports May 10, after the close.

The Estimize community calls for EPS of $0.46, four cents above Wall Street. Revenue expectations from Estimize are also higher at $893M as compared to the Street’s $886M. Estimates have remained relatively flat over the last 3 months, with EPS expected to grow 18%, and sales anticipated to remain in-line with year-ago results. EA tends to be a big mover after earnings, with the stock increasing 5% on average in the 30-day post report period. The company has a decent history of beating, surpassing the Estimize EPS consensus in 78% of reported quarters, and revenues 56% of the time.

Leave A Comment