Earnings season has commenced again. And investors tracking specific stocks will be keenly monitoring whether select stocks outperform or underperform consensus estimates for Q1 2017. In general, the mood is optimistic: “Revenue and earnings are expected to trend upwards,” wrote Terry Sandven, US Bank Wealth Management chief equity strategist. “We continue to look for equities to grind higher as earnings trend upwards.”

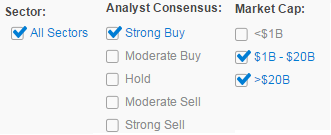

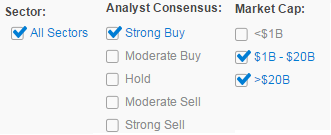

For investors looking for fresh investment inspiration, TipRanks’ earning calendar is the perfect tool. Unique stock analysis insights are incorporated into the calendar via the analyst consensus rating and the average analyst price target so you can immediately see the upside potential of each stock. Investors can also filter the stocks displayed by market cap, sector and analyst consensus rating (be it strong buy, hold or strong sell for example) to find the best stocks to follow. Add the stocks to your Smart Portfolio to receive ongoing updates on earnings and dividends.

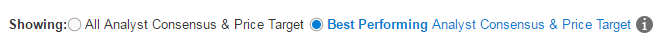

The result: a customized earnings calendar based on stocks that match your specific investing criteria. Even better, TipRanks users have the option to refine the analyst consensus and price target to recommendations to only the best-performing Wall Street analysts that consistently outsmart the market.

So, with the best-performing analyst option, we used the following filters- $1 billion to $20 billion market cap, all sectors and strong buy sentiment, in order to find 5 top stocks to track this earnings season.

1. Visa (V)– this global payments company is due to release its earnings on April 20. It has a strong buy rating with only buy recommendations from best-performing analysts. Five-star Barclays’ analyst Darin Peller says he “strongly recommends” the “historically undervalued” stock adding that he finds management guidance conservative: “we see potential for guidance to be raised again with F2Q results and we model for EPS of $0.81 (vs. consensus of $0.79) and net revenue of $4.32bn (vs. consensus of $4.31bn)”. Peller reiterated his buy rating on April 13 with a $103 price target (15% upside from the current price).

Leave A Comment