(Photo Credit: nick damico)

Tuesday, September 1

Thursday, September 3

Friday, September 4

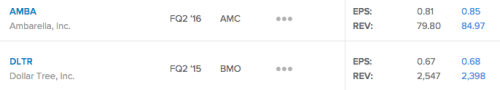

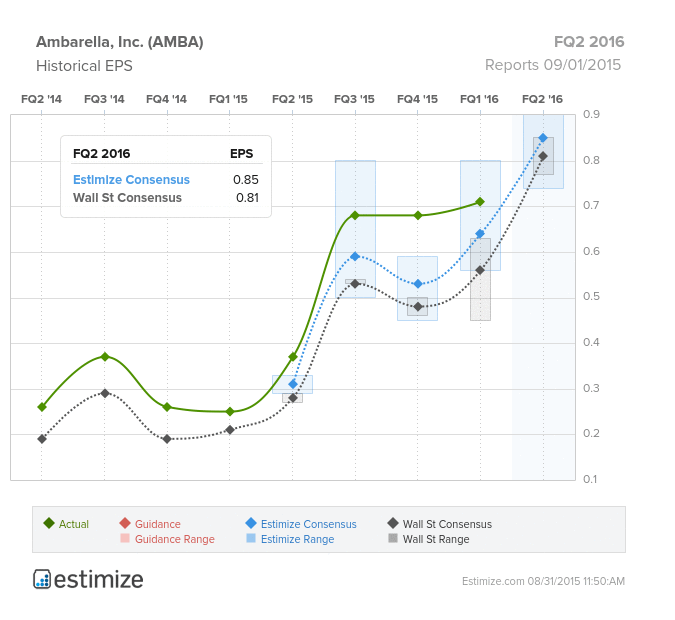

Ambarella, Inc. (AMBA)

The Estimize Consensus calls for EPS of $0.85 vs. Wall Street’s $0.81. The Estimize Consensus predicts revenue of $84.97M compared to the Street’s $79.80M.

What to watch for: Ambarella, developer of HD video compression and image processing products, has experienced a rapid increase in stock price, 150% over the past year. One of their biggest clients, GoPro, uses Ambarella SoCs (System on Chip) for their HD cameras and is responsible for that rally, with AMBA stocks reacting positively to GoPro’s better-than-expected Q2 earnings. SoC heavy products such as the GoPro HERO4 collection also accounted for more than 50% of revenue, confirming high sales for Ambarella. Also, the recent hype in drone technology further expand the market for Ambarella, increasing investor confidence.

However, the stock experienced its first major price drop on August 20th as Qualcomm announced that they will be developing their smartphone SoCs for drone applications as well. The stock took another hit last week as a result of China’s currency devaluation as Ambarella products will now be more expensive. So whether or not Ambarella can regain its upward momentum depends on its earnings Tuesday.

Dollar Tree (DLTR)

The Estimize Consensus calls for EPS of $0.68 vs. Wall Street’’s $0.67 and guidance of $0.66. The Estimize Consensus predicts revenues of $2.4B compared to the Street’s estimate of $2.55B and guidance of $2.20B.

What to watch for: Dollar Tree is now the largest deep-discount retailer in the country, after it’s acquisition of Family Dollar Stores, they now operate 13,500 stores nationwide, vs. competitor Dollar General’s 11,000. That acquisition is huge for DLTR and should help with operational and distribution efficiencies as the company charges forward with store expansion plans, especially into new markets, as well as with their omni-channel development to capture the online market. Dollar Tree stores typically occupy small neighborhoods, too small for Wal-Marts. But the discount wars are heating up as Wal-Mart and even Target eye smaller neighborhoods. Wal-Mart plans to open up 200 smaller stores this year alone, bringing the total up to 700 of its 3,200 stores worldwide. Target is further behind, but has made opening up their TargetExpress stores a main priority going forward. The dollar store industry has been strong recently, with DLTR’s stock up about 9% YTD.

Leave A Comment