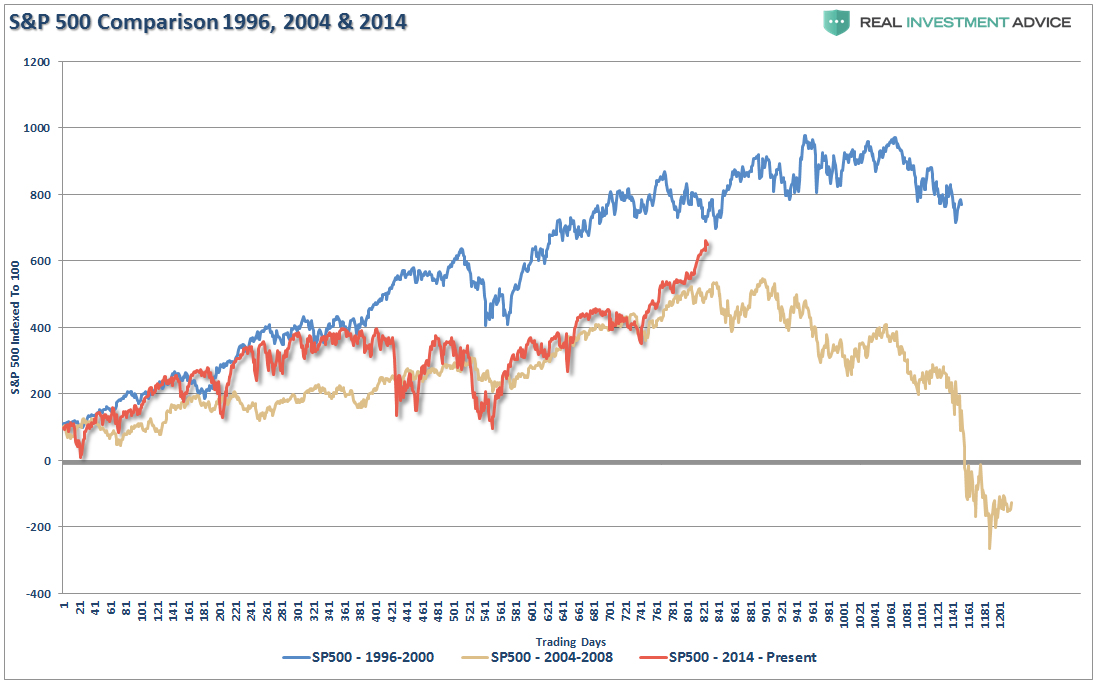

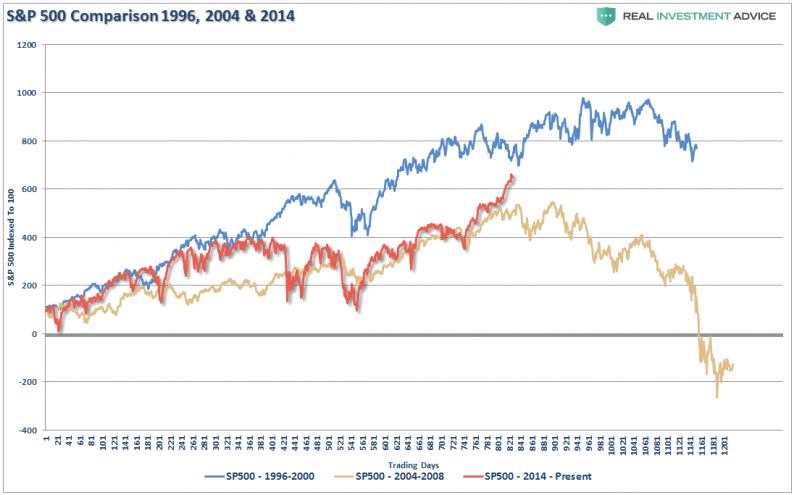

Last week I reviewed Why This Market Reminds Me Of 1999:

“While there is much hope the new President, and his newly minted cabinet, will “Make America Great Again,” there can be a huge difference between expectations and reality. And, like in 1999, there is just the simple realization that eventually excesses will mean revert.

But like I said, with only a 6-month holding periods, fundamentals ‘need not apply.’

So, while I don’t like chart price comparisons in general, if you take the sum of the economic and fundamental data above and compare it to previously ‘overly exuberant’ periods, you see this:”

Note: S&P 500 has been indexed to 100 to compare price movement during the 1200 trading days measured.

This past week, several areas of the market began to unravel.

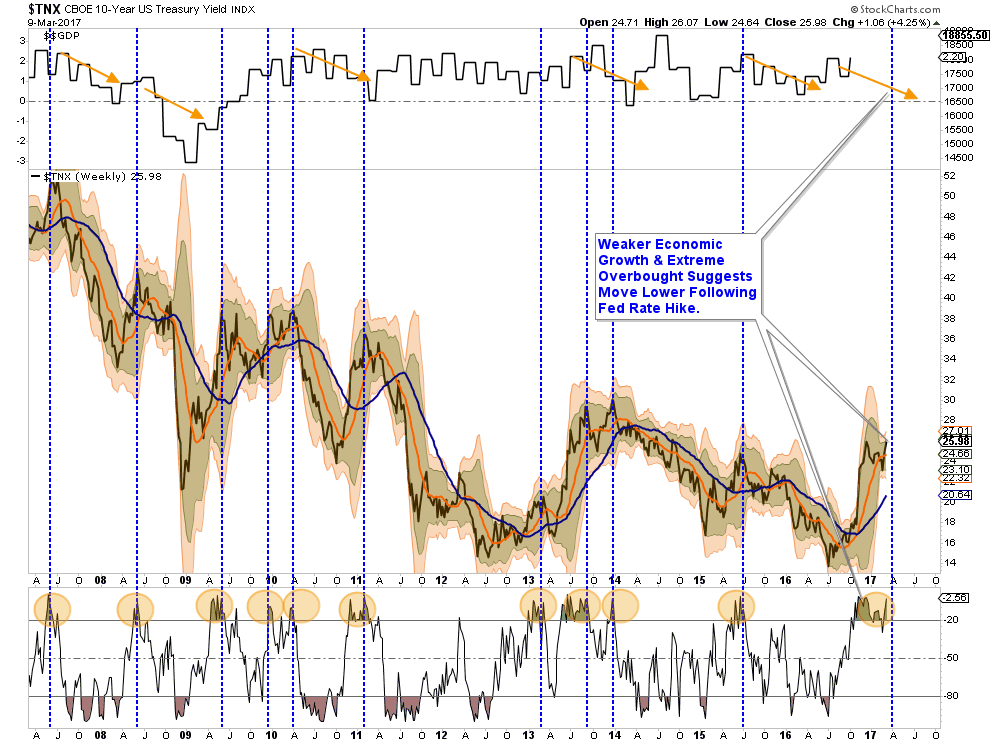

First, the bond market was hit hard as expectations of a Fed rate hike next week sent money scurrying out of bonds.

However, this recent pop in rates, when combined with a stronger dollar which drags on corporate exports (roughly 40% of earnings), has historically been an excellent opportunity to add to bond exposure. As shown below, the Federal Reserve, in their eagerness to hike rates, are once again likely walking into an “economic trap.”

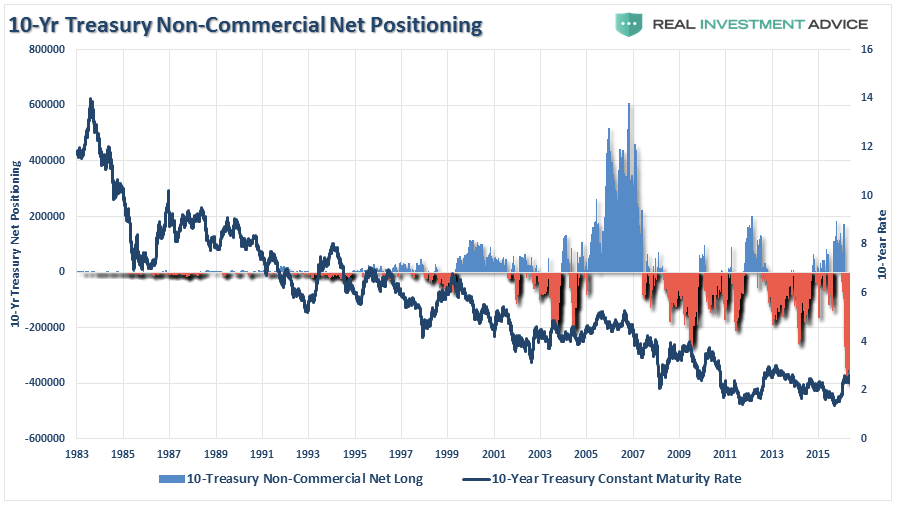

Also, whatever causes the next reversal in rates will coincide with an unwinding of the still very massive speculative net short in bonds.

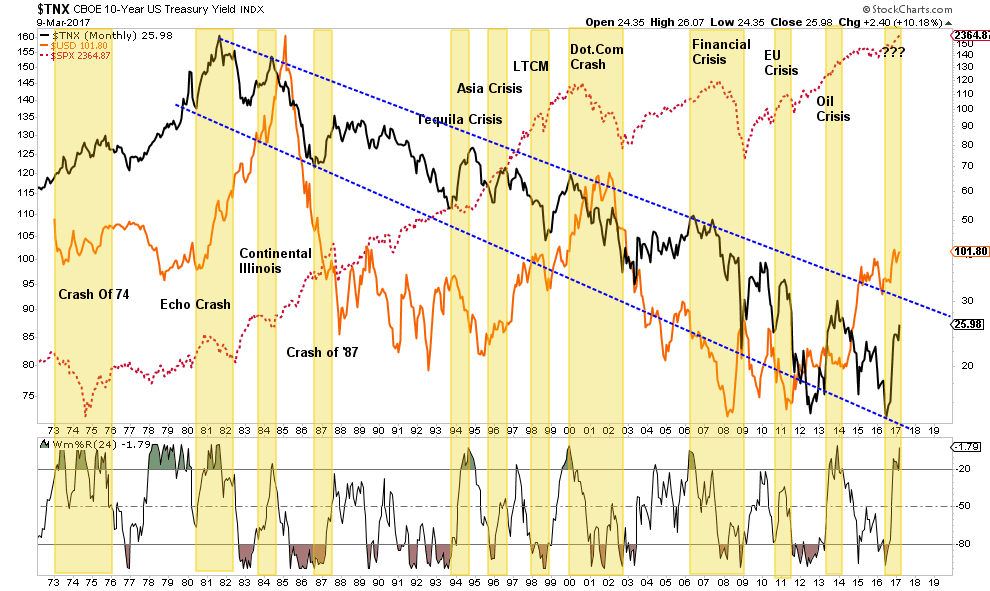

I agree with Albert Edwards on his discussion of rates.

“Make no mistake. Unlike most in the markets, I remain a secular bond bull and do not think this 35 year long bull bond market is over. I believe the US Fed has created another massive credit bubble that will, when it bursts, lay the global economy very low indeed. Combine this with the problems of a Chinese economy dependent on increasingly ineffective injections of credit to produce increasingly pedestrian GDP growth and you have a right global mess. The 2007/8 Global Financial Crisis will look like a soft-landing when the Fed blows this sucker sky high. The seeds for that debacle have already been sown with the Fed having presided over one of the biggest corporate credit bubbles in US history. All that is needed now is for the Fed to sprinkle life-giving rate hikes onto these, as yet dormant, seeds of destruction. Accelerated Fed rate hikes will cause tremors in the Treasury bond markets, forcing rates up, most especially in the 2 year – just like 1994. But as yet another central bank-inspired global recession unfolds, Ibelieve US 10y bond yields will ultimately converge with Japanese and European yields well below zero – in other words, buy 10y bonds on weakness!”

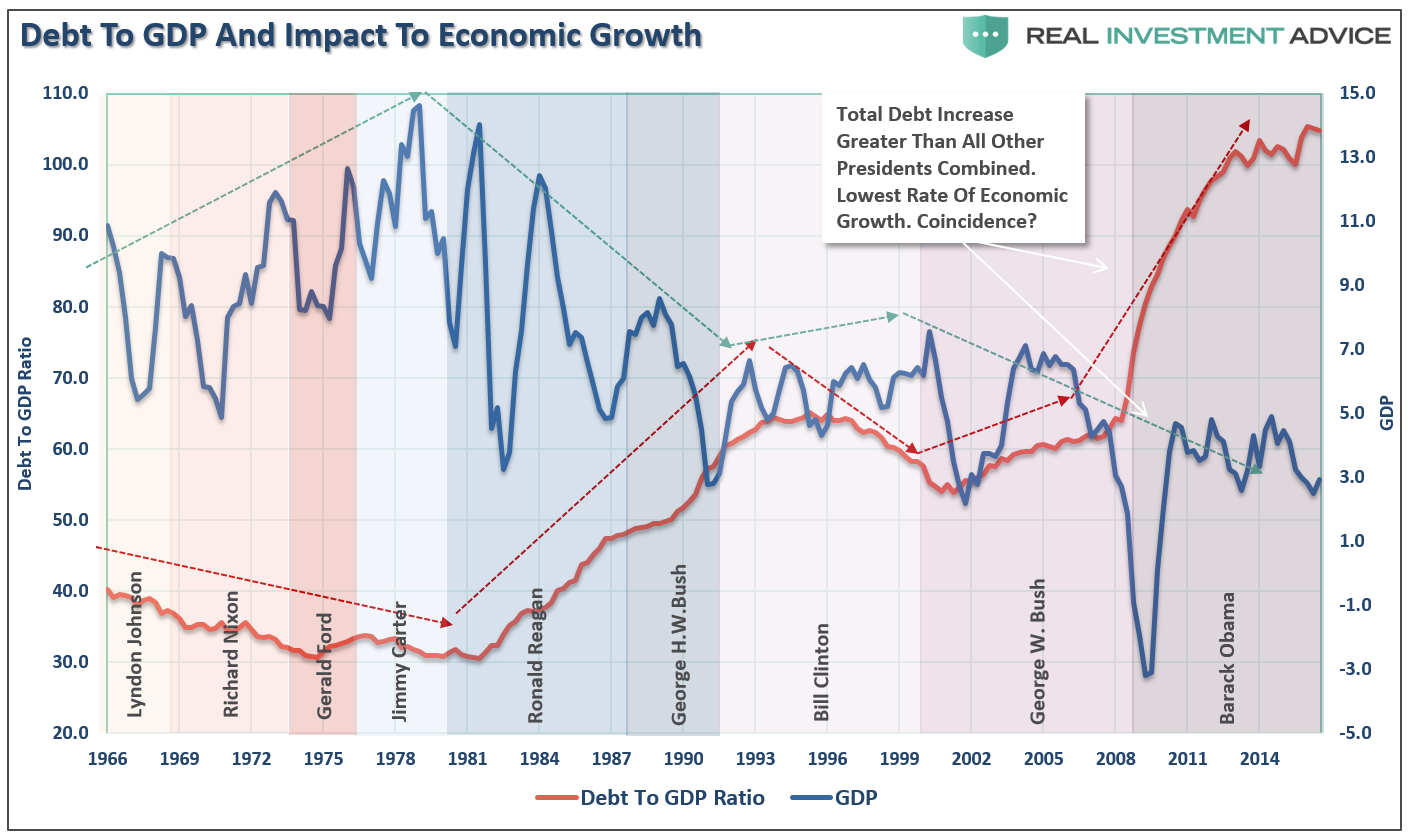

Of course, it isn’t JUST the Federal Reserve hiking rates which pose a risk to the markets. There is also this little problem that suggests rates will remain low for a very long time to come.

Secondly the oil market. As I discussed a few weeks ago:

“Crude oil positioning is also highly correlated to overall movements of the S&P 500 index. With crude traders currently more ‘long’ than at any other point in history, a reversal will likely coincide with both a reversal in the S&P 500 and oil prices being pushed back towards $40/bbl.”

Of course, with oil companies rushing out to increase drilling following the recent pop in oil prices, it was only a function of time until someone woke up to the reality of the build in still bloated inventories. (Also, despite President Trump’s exuberance over the building of the XL Pipeline, the last thing oil companies need right now is another 800,000/bbl’s a day in supply.)

Leave A Comment