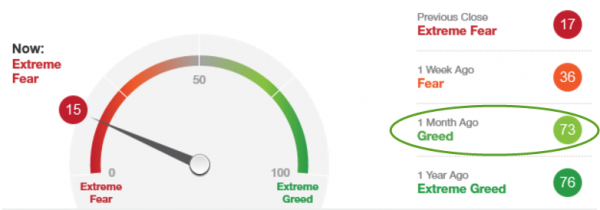

A 2.8% drop in stocks is all it takes…

…to convert sheer near full euphoria into outright panic…

Source: CNNMoney

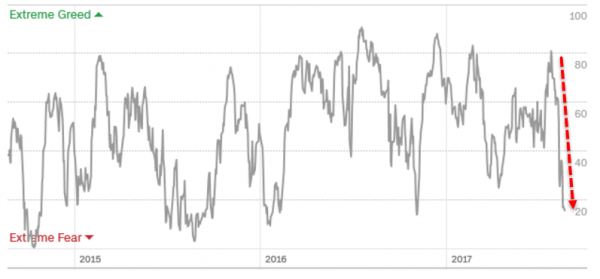

Quite a collapse in confidence for a ‘blip’ in stocks… (NOTE – this collapse in sentiment is bigger and faster than the plunge in Aug 2015 following China’s devaluation and the US flash crash)

At the same time, the ‘plunge’ in stocks has hammered BofAML’s Global Panic-Euphoria index out of ‘Euphoria’…

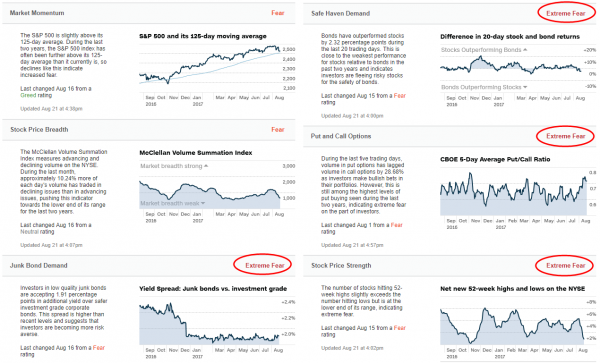

On a global basis, put-call ratios signal less euphoria than a month ago, and volatility has risen, taking Global Risk-love indicator from a protracted period in euphoria to barely inside the neutral zone.

With most of CNN’s Fear & Greed factors suddenly flashing “Extreme Fear”…

But there’s just one big caveat – almost 40% of the S&P 500 members are now trading below their 200-day moving-averages…

And that is what years of Central Bank conditioning does for investors’ risk appetites.

Leave A Comment