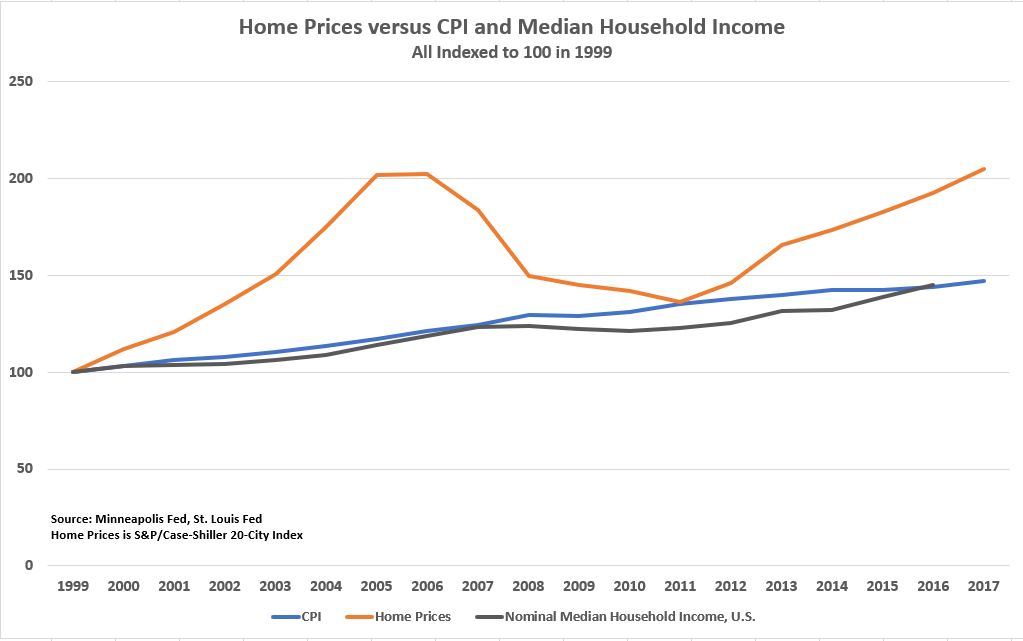

It’s official — house prices are now as high as they were at the bubble peak in 2006 according to the S&P/Case-Shiller 20-City Composite Home Price Index. Moreover, Americans believe they will continue to soar, according to an article by Quentin Fottrell at MarketWatch. That makes sense from the perspective of behavioral finance. People often extrapolate recent price movements into the future, which contributes to plenty of misjudgments and sometimes bubbles and crashes.

Does all this mean prices are now in bubble territory again? It’s not so easy to say because a bubble is hard to define. But it sure looks like prices are expensive on some reasonable metrics.

First, it has taken 12 years to regain the 2006 bubble peak. That’s a reasonably long period of time. Also, if prices are indexed to 100 in January 2000 and the index is a 209 now, that means home prices have appreciated around 4.1% annualized. That doesn’t seem like a crazy rate of appreciation, but the problem is that inflation, measured by the CPI has increased by 2.1% over that time. And median household income has increased by 2.2% from 2000 through 2016.

One problem with this analysis is that the 20-City Index might be weighted more heavily to areas where people’s wages are increasing at higher rates than the median. The U.S. economy is bifurcated now so that people living in the 20 cities in the index might be doing better than people in the rest of the country. The 20-City index contains New York and San Francisco, after all. Also, at least some of the cities in the 20-City Index suffer from severe supply constraints due to onerous zoning regulations.

New Approach to Measuring Affordability

Not only is measuring median prices to median income across the country inadequate, but so is measuring those things in a particular area. Median income and prices don’t capture the full distribution of incomes, and they don’t focus on renters specifically – those best positioned to become first-time home buyers — according to a recent study by the Urban Institute. Nor do median numbers capture the full distribution of home prices. In some areas, for example, there is a wide variety of homes available, but in other areas, there is only a narrow set of home types available. Additionally, focusing on renters is important because renters typically have lower incomes, making them less able to afford a home than the median family.

Leave A Comment