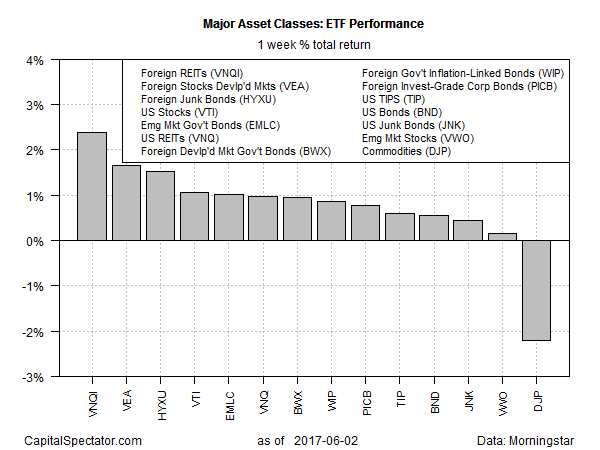

Property shares and real estate investment trusts (REITs) outside the US grabbed the top spot among the major asset classes for the five-trading days through June 2, based on a set of representative exchange-traded products. The gain marks the fifth straight weekly advance for these shares.

Vanguard Global ex-U.S. Real Estate (VNQI) posted a strong 2.4% rise for the weekly change, according to Morningstar.com. “There is a real opportunity here,” Duncan Rolph, a managing partner at Miracle Mile Advisors, told CNBC last week. “International real estate funds are priced less than U.S. [funds]. Yet they pay dividends over 4%”

Foreign real estate/REITs are also posting the highest expected risk premium for the long run at the moment among the major asset classes. This corner of global markets is currently expected to earn an annualized 9.5% return over the risk-free rate, based on an equilibrium methodology for predicting performance.

Meantime, broadly defined commodities continued to wallow in last place for the latest weekly results. iPath Bloomberg Commodity (DJP) slumped 2.2% over the five trading days through June 2.

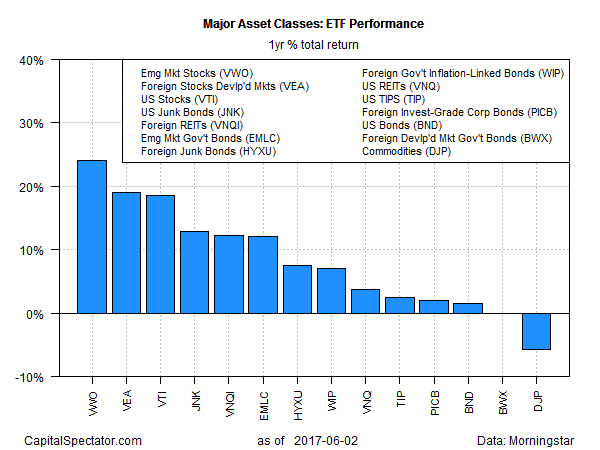

For one-year returns, commodities remained the big loser too. DJP fell deeper into the hole, posting a 5.8% year-over-year loss – the deepest annual setback among the major asset classes.

By comparison, emerging-markets stocks are still holding the top-spot for one-year results. Vanguard FTSE Emerging Markets (VWO) is up 24.1% on a total return basis for the trailing 12-month period. At last week’s close, the ETF edged up to its highest level in more than two years.

Leave A Comment