I must confess that a recession is on my mind. It is the decline in the markets coupled with the recession currently occurring in the goods producing sectors which has me looking harder for a decline in the service sector (which continues to grow). Likely, if a slowing begins in the service sector in the next few months, it is entirely possible that the recession would be marked in 4Q2015. On the other hand, if the service sector remains relatively strong it is unlikely a recession will be seen at this time.

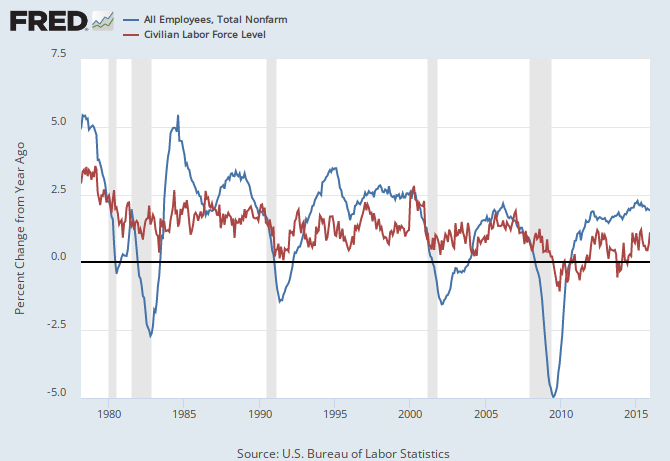

I have no love for the way the economy is measured.In business, your organization is no stronger than your weakest link. The links in the economy are people. The measurements therefore should be on the median to lowest people in the economy. The 0.1% do not need monitoring. The tools to measure would be employment and income. Employment is still recovering and is providing more and more of the population’s jobs – slowly but surely. Even though I have attacked the way employment is monitored, there is no argument that employment is improving (improving but at a slower pace than the rate the headlines show).

Employment growth, however, is driven by dynamics which occur months earlier – and therefore does not drive the future economy. It’s an old canard that employment is a lagging indicator. So the Federal Reserve’s concentration on employment as a guide when to raise the federal funds rate is misguided. As predicted, the economy was declining as the Fed adjusted the rates in December 2015. In the recent meeting statement, the Federal Open Market Committee (FOMC) did NOT continue their adjustment of the federal funds rate because “….economic growth slowed late last year.” Gee, what a surprise to most except for the Federal Reserve.

Also median inflation adjusted family income continues a slow recovery process – and is currently back to pre-Great recession and within about 1% of the January 2000 level.

Leave A Comment