Australia just celebrated setting a (modern era) world record for the longest string of quarters without a recession. Yet Australia’s economic backdrop appears to be wavering. This week’s labor force survey could provide a critical point of relief or pile on yet more concern.

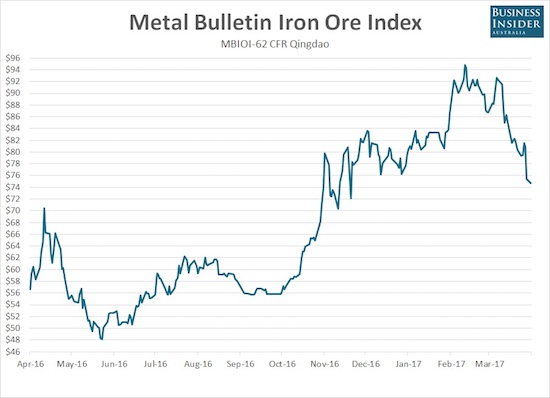

Iron Ore’s Latest Plunge

I begin with iron ore – Australia’s most important export. The price of iron ore has taken a wild ride since it bottomed in late 2015. Over the past year in particular, the price of iron ore has been subject to brief periods of abrupt and sharp price spikes and declines. The current decline is the most extended in a year. At this point, iron ore has essentially wiped out all its gains since the U.S. Presidential election (yet one more price that has completely reversed its post-election move).

A fresh plunge for iron ore has taken it off a multi-year high and returned it to early November levels.

Source: Business Insider

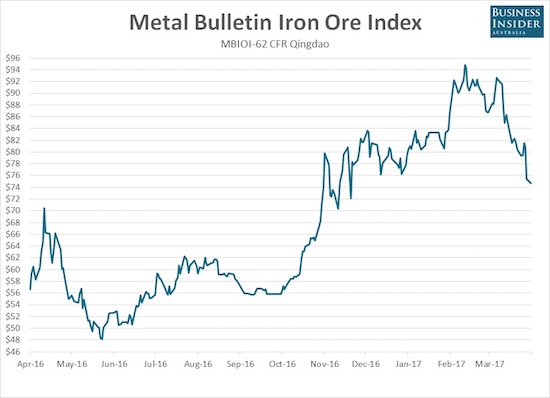

The Australian Dollar

The recent peak in iron ore coincided with a peak in the Australian dollar (FXA). Surprisingly, the subsequent decline in the commodity-dependent currency has not been particularly vicious. The Australian dollar even managed to stage a very sharp relief rally against the U.S. dollar after the Federal Reserve increased its interest rate in mid-March. Yet, the technical damage is clear, especially against the U.S. dollar (AUD/USD).

The Australian dollar has confirmed a double-top against last year’s resistance versus the U.S. dollar with two breakdowns through 200DMA support.

Source: FreeStockCharts.com

GDP and Unemployment

The decline in iron ore does not bode well for economic reports in coming months…especially since economic reports during iron ore’s massive surge failed to boost the economy. Neither unemployment nor GDP in Australia seemed to benefit. In fact, while unemployment ticked downward slightly, overall GDP growth seemed to worsen a bit.

Leave A Comment