On Sunday, Abe won the snap election in Japan. What does it mean for the gold market?

Over the weekend, the general election to Japan’s House of Representatives took place. The Liberal Democratic Party coalition won, gaining 284 seats, while the Komeito got 29 seats. It means that the ruling coalition won 313 seats combined and will keep its two-thirds supermajority in the lower house of the parliament.

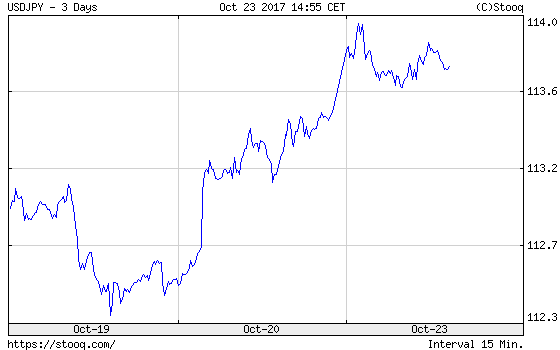

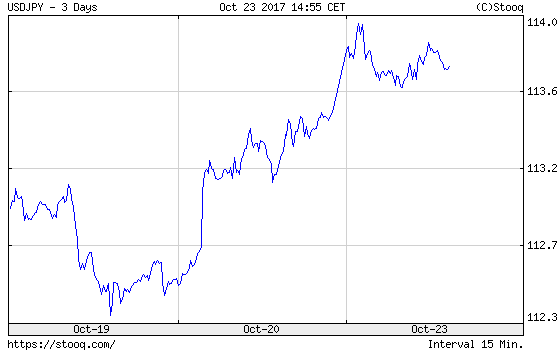

The results are negative for the gold market. Abe’s triumph indicates that we will see a continuation of very accommodative monetary policy. Abenomics would keep downward pressure on the yen. It provides support for the U.S. dollar, which is usually bearish for the yellow metal. As we predicted earlier this month, the greenback appreciated against the yen after the results were revealed, while the price of gold declined, as one can see in the charts below.

Chart 1: USD/JPY exchange rate from October 19 to October 23, 2017.

Chart 2: Gold prices from October 20 to October 20, 2017.

Abe’s triumph is not the only factor behind the short-term dollar strength. The renewed hope about tax cuts and rising speculation that Trump could nominate a more hawkish person than Janet Yellen as the next Fed Chair will add some fuel to the greenback’s rally (we write about it more in the recent edition of the Market Overview). Another reason is political turmoil in Spain after the central government outlined measures to take control of Catalonia. The only rescue for gold may now come from the ECB. The bank holds its monetary policy meeting on Thursday. The ECB is expected to announce more details on the winding down of its bond-buying program. If Draghi sounds more hawkish than expected, the euro may gain, which could support the price of gold. However, even if this happens, it could be not enough to counteract the positive sentiment towards the U.S. dollar emerging from progress towards tax reform and expectations of a more hawkish Fed from February 2018 onwards.

Leave A Comment