About the Gold and Silver sector: As painful as this has been for long-term investors, the upside euphoria and mania is still in front of us. For people who can’t handle this cyclical bear phase, they will be shaken out of their positions. The reality is that bear markets are designed to shake out all of the weak hands. We are in the final stages of that process right now. For those who can endure the final stages of this bear market, the upside gains will be one for the history books.

Gold is currently retesting the August low of 1,085 US per ounce. Further downside would almost be anticipated with a hike in interest rates, but the shallow liquidity of the gold market and its quick readjustments encourage that this news has already been priced in. In less than two weeks the price of gold has given back 90 dollars. Whether support at the 1080 level holds will be the ultimate question, but with the next phase of conversation around the US Fed will not be when they raise rates, but when can they do it again and to what level.

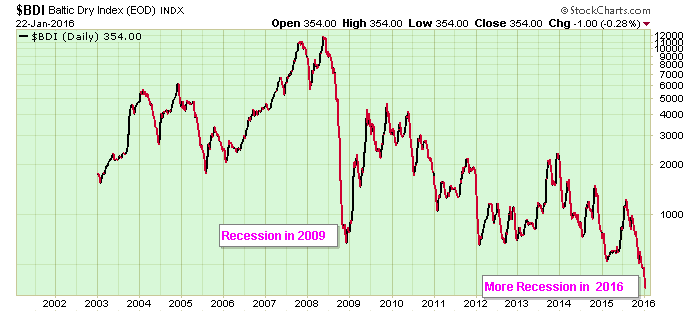

The Hike in interest rates planned for December will NOT happen as the World economy is sliding further in a DEPRESSION. The Baltic dry index is an excellent indicator. If you look at nearly any freight index, you will see weakness and contraction. Whether it be total trade, shipping rates or even the amount of “empty containers” moving around the world, you will see weakness. The picture of trade is that of a global contraction!

Leave A Comment