AT40 = 61.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 59.8% of stocks are trading above their respective 200DMAs

VIX = 9.9 (volatility index)

Short-term Trading Call: cautiously bullish

Commentary

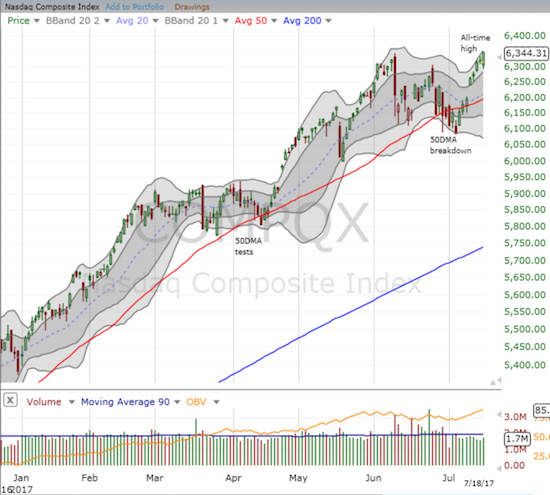

The S&P 500 (SPY) closed effectively flatline with a point and a half gain. The Nasdaq returned to the new-high business with a 0.5% gain. The PowerShares QQQ ETF (QQQ) did not quite reach a new all-time high with its 0.7% gain on the day.

The S&P 500 made a marginal new all-time high.

The Nasdaq rejoined the new all-time high crew with a small yet convincing rally.

The PowerShares QQQ ETF out-performed the Nasdaq but could not quite reach a new all-time high.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), failed to benefit from the gains in tech and closed DOWN to 61.9% from 65.4%. This retreat was right on the border of a bearish fade from the overbought threshold (70%). My short-term trading call survived at cautiously bullish. I even chose to buy call options on QQQ after it recovered from the day’s small loss. I did the same on Apple (AAPL). I also bought call options on ProShares Short VIX Short-Term Futures (SVXY) for (hopefully) a quick flip.

Now for some action in individual stocks…

Chipotle Mexican Grill (CMG)

Sometimes it really pays to follow a stock very closely.

As regular readers know, I have periodically followed CMG for weekly trades. For a number of weeks earlier in the year I was focused on buying weekly call options. I switched to buying put options after the stock broke down below 200DMA support in the wake of the company’s updated guidance. On Monday, July 17, 2017, I noticed the put options were unusually expensive, yet I found no upcoming news for the week like earnings (which are next week). I almost decided to drop my regular purchase of put options for the week. However it occurred to me that the market just might be saying it expected some bad news to come.

Leave A Comment