AT40 = 47.0% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 53.0% of stocks are trading above their respective 200DMAs

VIX = 14.6

Short-term Trading Call: neutral

Commentary

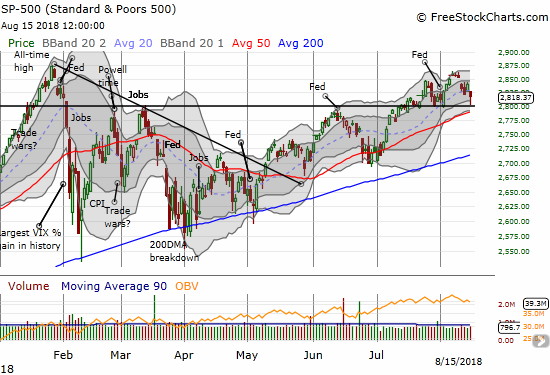

I typically consider the market stretched to the downside when AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), drops below 20%. However, the current market is characterized by stubborn buyers stepping in at picture-perfect support levels no matter the headlines and sellers generally lacking staying power or enthusiasm. So with AT40 closing at a new (marginal) 3-month low and dropping down as far as the June intraday lows that marked rebounds, I decided to make a bullish interpretation of the trading action.

The volatility index, the VIX, soared on the day on Wednesday. It gained as much as 26.7% before fading hard to close with a 10.0% gain. The volatility faders were as effective as ever as the VIX failed to stay above the 15.35 pivot.

The volatility index, the VIX, failed to stay at lofty levels and closed under the 15.35 pivot.

While I was able to profit from last week’s small volatility spike, I failed to profit from this much larger one. After taking quick profits on my last tranche of call options on the ProShares Ultra VIX Short-Term Futures (UVXY), I stuck to my strategy of setting limit buy orders for the next tranche of calls, but they never triggered…including today’s attempt. My disappointment transitioned into realization given I never chase a surge in the VIX: I flipped the script of the last many weeks and, for the first time in a long time, bought put options on UVXY. So far, so good on this play for the near inevitable return to market complacency.

Part of my realization came from noticing the S&P 500 (SPY) lingering just above the 2800 level. In my last Above the 40 post, I claimed that the index’s 2800 support was in play given the latest bearish taint to the market. I reacted by first taking profits on my SPY put option. After sellers pushed the S&P 500 even closer to support, I decided to buy the UVXY put options. The S&P 500 closed the day with a 0.8% loss.

The S&P 500 (SPY) bounced off 2800 support in picture-perfect style.

The Nasdaq also completed a picture-perfect bounce from support that I last week claimed was in play. The tech-laden index’s 50DMA held as buyers arrived on schedule. Buoyed by AAPL, the Invesco QQQ Trust (QQQ) never made it to 50DMA support. The ETF bounced just above 50DMA support; buyers decided to arrive at the top of the lower-Bollinger Band (BB) channel.

Leave A Comment