AT40 = 54.6% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.5% of stocks are trading above their respective 200DMAs

VIX = 11.2 (10.8% drop) (volatility index)

Short-term Trading Call: neutral

Commentary

It is not easy catching a yo-yo…

Source: Giphy

There are all sorts of nicknames possible for a churning market. In this edition of “Above the 40,” I use a yo-yo to describe the market’s tantalizing lurches up and down. These moves within shouting distance of all-time highs must be frustrating bears and bulls alike who want to stick by a trade for more than a hot minute. (For example, the market gave me less than half a trading day to profit nicely from my latest put on Chipotle Mexican Grill (CMG), and I failed to seize the opportunity – the benefits of a trailing stop to preserve profits!).

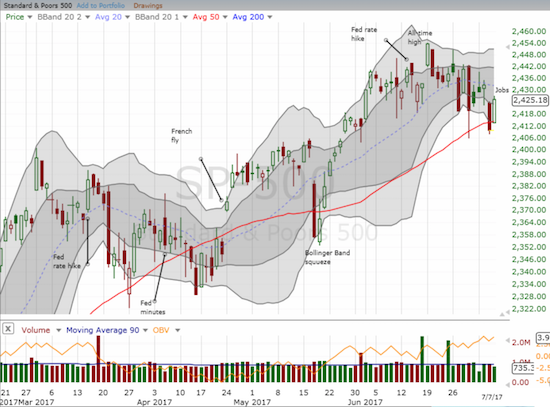

Friday’s catalyst was presumably the U.S. non-farm payrolls – the jobs report – for June, 2017. Strong numbers put the market right back into a good mood. The S&P 500 (SPY) delivered the bounce that I anticipated. The move allowed me to close out my call options on SPY with a near double.

Almost clocked a double. Sold $SPY calls here. #122trade

— Dr. Duru (@DrDuru) July 7, 2017

It was too much to expect confirmation of the 50DMA breakdown. The S&P 500 (SPY) bounced back nicely – now watch the declining 20DMA.

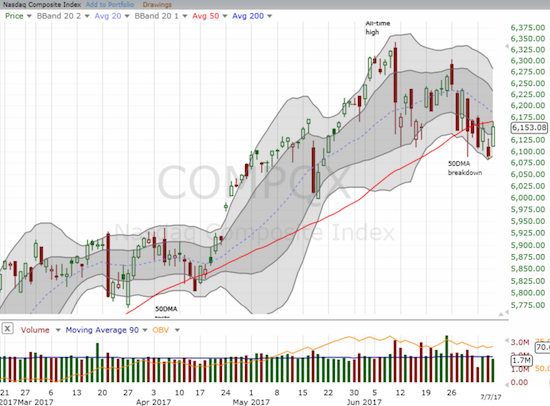

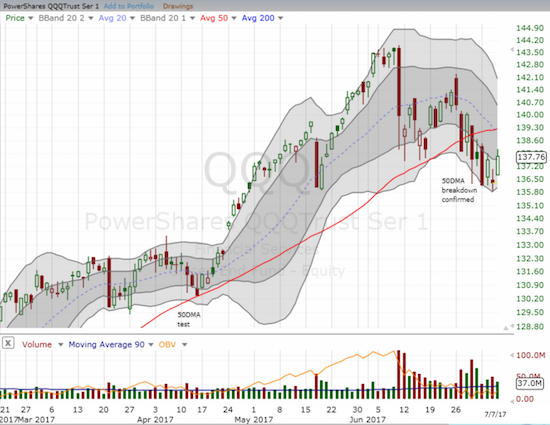

The Nasdaq also benefited from the good mood for the day. The tech-laden index gained 1.0%, enough to neatly touch resistance at its 50-day moving average (DMA). The PowerShares QQQ ETF (QQQ) increased by a similar amount and reached the top of its downtrend channel.

The Nasdaq closed just short of 50DMA resistance.

The PowerShares QQQ ETF (QQQ) rallied but still sits just barely within its downtrend channel.

I used the bounce to reload on put options on Apple (AAPL) and on Netflix (NFLX). AAPL performed in-line with the Nasdaq and NFLX zipped higher by 2.7%. Amazon.com (AMZN) and Facebook (FB) were the two “usual suspects” which changed their technical positioning with solid breakouts above 50DMA resistance. Both stocks closed on downtrending 20DMAs. Nvidia (NVDA) is starting to look ready for another run-up. The stock logged its third consecutive gain and today confirmed a break above its short-term downtrend.

Leave A Comment