AT40 = 57.2% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.8% of stocks are trading above their respective 200DMAs

VIX = 11.2 (was as high as 13.2)

Short-term Trading Call: cautiously bullish

Commentary

It took three days for the volatility faders to show up again. Nerves in volatility trading stretched for a third day with the VIX trading as high as 13.2 and a 18.3% gain. The VIX ended the action with a fraction of a percent to call a gain.

The volatility index, the VIX, has not traded three straight days to the upside since the first surge in August.

Always wary of the fleeting gains in going long volatility, I locked in a double on my call options on ProShares Ultra VIX Short-Term Futures (UVXY). While this gain on my latest tranche of UVXY calls was gratifying it ended a losing streak in place since September. The month was surprisingly placid and laid consistent waste to my once every two week UVXY hedges. It was a marked contrast to the small profits I eked out in August and the beginning of September.

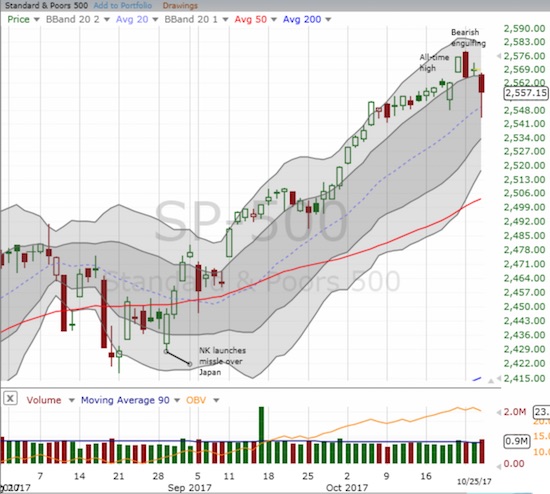

The surge in volatility was large enough to flag a major sell-off. Yet, the S&P 500 barely lost 1% at its lowest point on the day. The index closed with a 0.5% loss. The recovery was important for my trading call. As I indicated in my last Above the 40 post, I planned to flip the short-term trading call all the way to cautiously bearish if the S&P 500 closed below last week’s low. As the chart below shows, the S&P 500 turned in a close call!

The S&P 500 (SPY) sliced through the previous week’s low before buyers rushed in to avoid a bearish breakdown.

Given the major fade of volatility, I am inclined to believe that sellers have exhausted themselves. However, the underlying weakness in the market remains. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), dropped from 62.8% to 57.2%. This level is still far from oversold (20%) or “close enough” to oversold (low 30%s). The new bearish turning point is now a close for the S&P 500 below today’s intraday low (2,544). AT200 (T2107), the percentage of stocks trading above their respective 200-DMAs, dropped to a 1 month low.

Leave A Comment