Over the past two weeks we observed two curious, vol-related phenomena.

First, it was Tom DeMark cautioning that even as stocks have surged, the amount of VXX shares outstanding has soared to record highs, a seemingly contradictory confluence of events because it suggested that investors, traditionally “going with the market flow”, are betting on a major vol reversal and furthermore the move contradicts historical shifts in VXX holdings at times of extreme market upside.

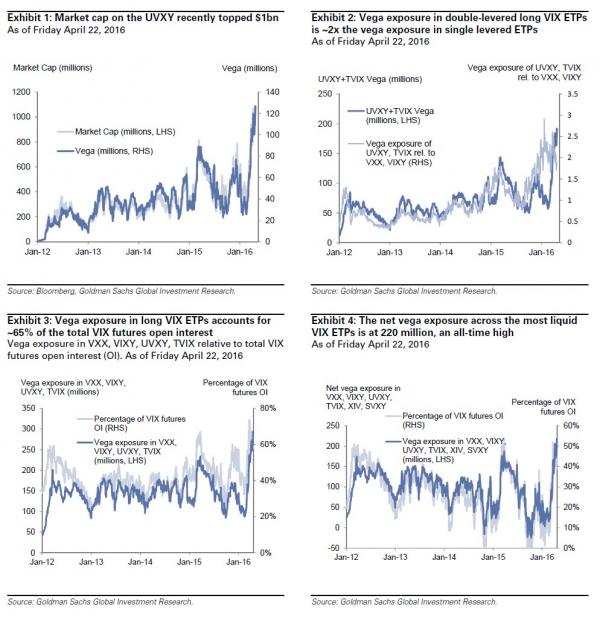

Second, just days later, Goldman confirmed as much when looking at overall market volatility, admitted that “our view that the VIX may remain low in the near term is at odds with the VIX ETP market, as investors seem to be pouring money into levered long VIX ETPs.” Goldman’s derivatives team also wrote that “while long ETP exposure has been growing, the appetite for inverse VIX ETPs, which benefit from declines in volatility such as the XIV and SVXY, has been muted, with vega exposure remaining range-bound in recent weeks. That’s surprising, since the benchmark index which these underliers track (SPVXSPI) is up 73% since the market low on February 11 and investors often follow performance!”

Goldman’s punchline: “Vega exposure on longs has tripled since February 11: The total amount of vega exposure across four popular long VIX ETPs (VXX, VIXY, UVXY, TVIX) has tripled since February 11 and recently stood at ~290 million, a record high.”

In short, someone has been aggressively preparing for the next vol spike episode, even as VIX itself has barely budged while the VXX recently hit fresh split-adjusted record lows.

All of this brings us to the point of this article, which focuses on the most recent observations by JPM’s quant guru Marko Kolanovic, who moments ago released his latest report. Not surprisingly for a man who deals with “Greeks” all day long, the topic of his note is precisely this curious decoupling between vol flows and realized vol. More importantly, it is volatility that is flashing a red light for Kolanovic, who says that “given the low levels of volatility and high levels of leverage, the main risk for the market remains a potential volatility shock.”

Leave A Comment