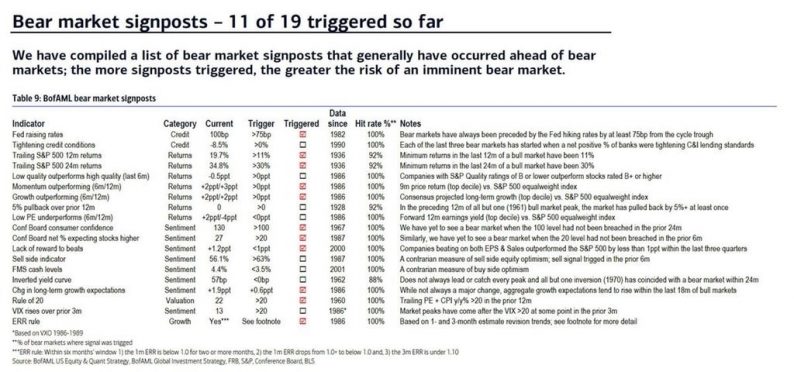

We reviewed the first 10 bear market signposts in a previous article. This article will look at the next few. Remember that, of the first 10, I felt 3 were irrelevant. The 11th signpost is triggered when the net percentage of consumers who think stocks will move up is above 20%. Since stocks move up about 70% of the time, I think such bullishness is low, but it’s the way the poll has always been oriented. Plus, most consumers don’t know that stocks go up that often. Either way, when the Conference Board’s survey, which shows the net expectation consumers have that stocks will go up, is above 20%, it has a 100% hit rate of being triggered within six months of a bear market going back to 1987. It has been triggered now because consumers are very optimistic about stocks as they suffer from recency bias. The longer the bull market lasts, the more bullish they are. This phenomenon may also occur because when bull markets are old, the employment rate is the highest.

Another aspect to keep in mind is that consumers might be more intelligent than in the past because of the advent of the internet. One example of their intelligence is the movement towards passive ETFs instead of staying with underperforming mutual funds. There are a couple aspects to this shift. The first is many mutual funds can outperform the market, but with their fees, they underperform the market. By switching from active to passive funds with low fees, investors are being smart consumers.

The second aspect is that this market cycle has been one which active managers can’t find alpha. By getting out of active funds now, it is a short term urge to get out of an underperforming business right at the end of the cycle. The fact that consumers know that these funds are performing poorly shows they are focusing on their returns instead of mindlessly throwing away the quarterly performance note. However, they may lack the foresight and historical framework to understand that active underperformance is cyclical. As you can see in the slide below, there has been little alpha lately. Alpha comes and goes with the market cycle, so completely abandoning the active strategy doesn’t necessarily make sense. My goal with this point is to show the perspective that there are cyclical and secular trends when it comes to the active versus passive discussion. Both are moving towards passive, but a changing market could mean the cyclical shift is near its end. The secular headwinds can become tailwinds at some point if the passive funds provide opportunities for stock pickers since passive funds don’t research names individually.

Leave A Comment