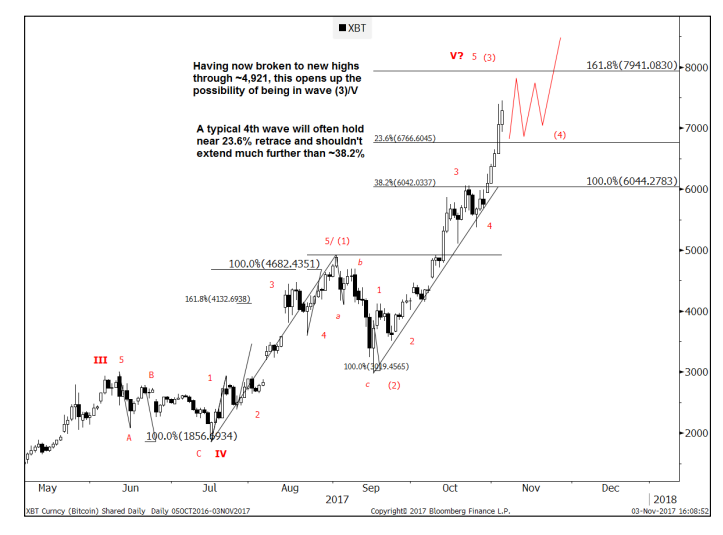

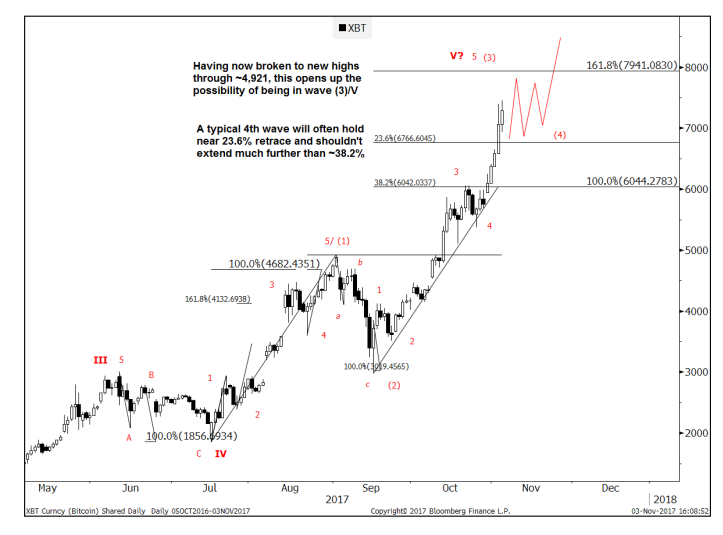

It wasn’t that long ago that Goldman Sachs was watching the $4,827 level on Bitcoin USD, predicting a bull market. This was before exchange heavyweight CMEGroup and Terry Duffy piled into what was declared an asset that could be “tamed.” In announcing the launch of Bitcoin futures, a move juxtaposed to that of JPMorgan’s Jamie Dimon, who called investments in the cryptocurrency a “fraud,” CMEGroup isn’t taking directional price exposure but rather transactional exposure. Such market gyrations are playing themselves out as Goldman Sachs, after accurately predicting the recent price rise in Bitcoin USD, now looks to $7,941 as a new cryptocurrency hedge fund launches in the wake the CMEGroup’s Bitcoin announcement.

Former Citadel portfolio manager launches cryptocurrency hedge fund despite seeing “hype” exceeding reality

When former Citadel portfolio manager George Michalopoulos decided to primarily trade cryptocurrencies in his newly formed hedge fund, he recognized it was an asset class where “hype has exceeded reality.”

“I understand the skepticism behind cryptocurrencies,” he told ValueWalk after announcing the launch of the Leonidis Cryptocurrency Fund on Typhon Capital’s Argos Fund Platform, first reported by HFMWeek. But to Michalopoulos, it looks like the 1990s with the launch of the Internet. On a long-term basis, “the technology is changing the game.”

Looking at the short-term price patterns, however, is where he sees a reduction in volatility and a consolidation in a trading range. But in 2018 he thinks the currency will continue its ascent higher. “Short term the market is a little one-sided,” he said, but he doesn’t see a major drawdown, just more consolidation. While there has not been a long statistical price history behind cryptocurrency trading, he notes that “investors have exhibited a tendency to withstand high volatility markets.”

Leave A Comment