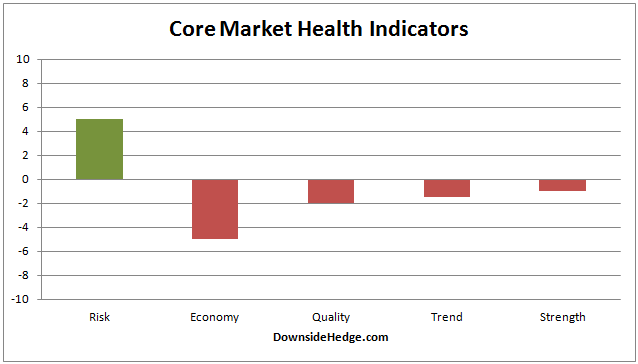

Over the past week all of my core measures of market health rose with the exception of the economy, which held steady. As price for the S&P 500 Index (SPX) rises, the internal indicators continue to improve. There are some short term divergences that may cause some consolidation in the near term, but overall the direction of the majority of indicators support a break to new highs. Although there was good improvement in the majority of the health categories, none of the negative ones rose enough to get above zero. I expect that both strength and trend may go positive by next week even if we get some small consolidation. A rally may drag market quality above zero as well.

With the current readings the core portfolio allocations remain the same. The volatility hedge is still 100% long (from 10/9/15).

Leave A Comment