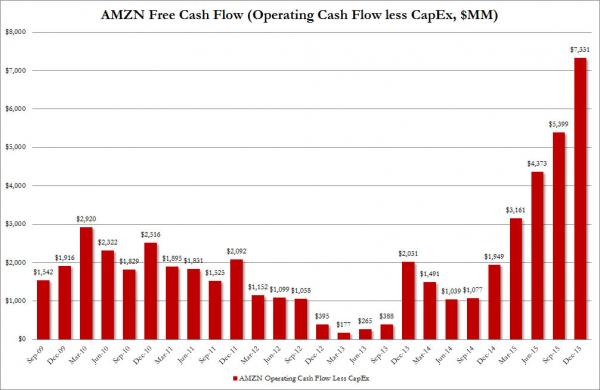

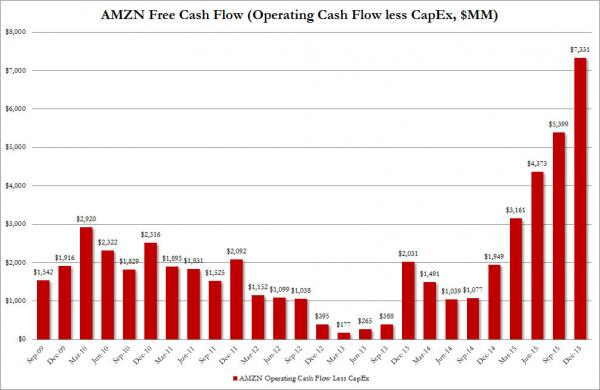

For years, shorts would tear their hair out quarter after quarter, when AMZN would continue to bleed cash with relentless abandon, only to see the stock soar after earnings. Now, in what may be a perfect poetic symmetry, following the quarter in which Amazon’s free cash flow soared to the highest in years, printing at $7.3 billion, or more than triple the year ago period…

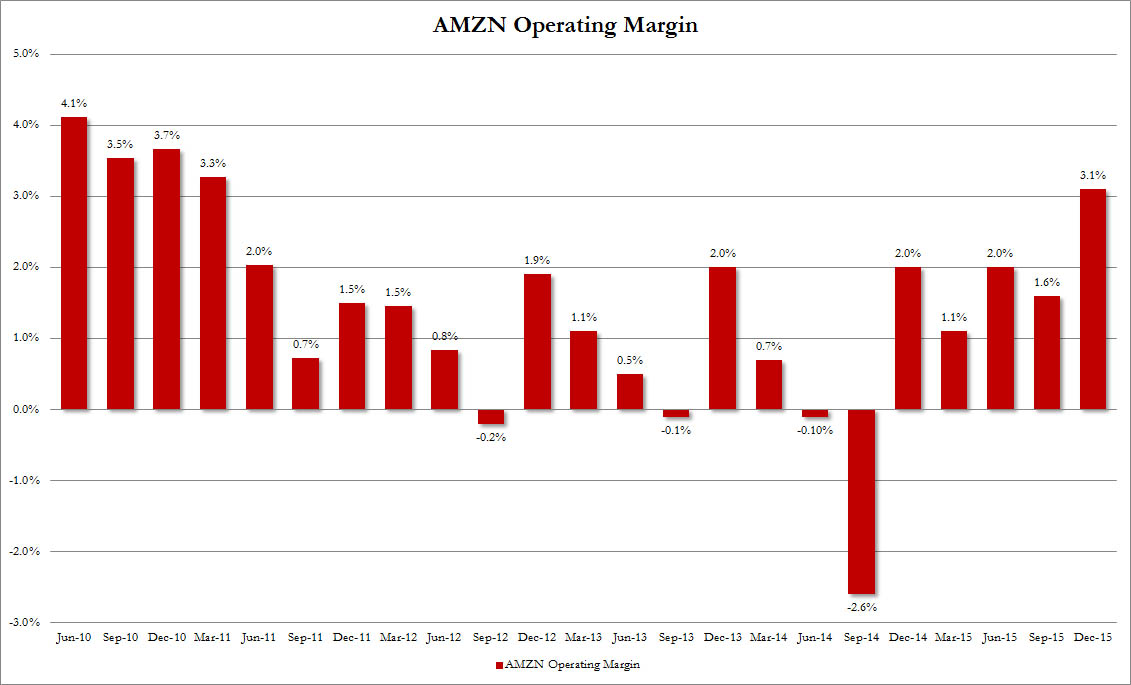

… on margins that are becoming respectable on both a quarterly…

… and LTM basis…

… The stock is crashing by 12% at this moment:

It wasn’t just that: one reason for the 13% plunge may be that in the holiday season in which many had expected that AMZN would take away market share from an imploding retail sector, revenue of $35.7 billion, a 22% increase, actually missed expectations of $35.9 billion, something AMZN has rarely done in the blockbuster for retail spending fourth quarter.

Another reason is that Wall Street finally got ahead of itself. By a lot: it was expecting AMZN to generate $1.55 in EPS. Instead, AMZN missed this by a whopping 30%, with a final Q4 EPS of $1.00 (more than doubling the year ago net income), on operating income of $1.1 billion (a nearly 100% increase from a year ago) which also missed expectations of a $1.24 billion number.

On the spending side, operating expenses increased 21% to $34.6 billion, making some question if the company’s core business profits will not be swept by Bezos’ many business growth ideas. The CEO’s biggest challenge is balancing Wall Street’s thirst for profits against his own ambitions of using new technology – such as unmanned drones and intelligent household gadgets. Bezos is also eager to replicate his U.S. success abroad, including challenging Flipkart Online Services Pvt. for India’s fast-growing e-commerce industry.

According to Bloomberg, “the result was a surprise for investors who have become accustomed to Amazon’s ability to fuel sales by spending heavily on delivery infrastructure and new products. The key question is whether the Seattle-based company can readjust its investments in the face of weaker than anticipated sales. Still, Chief Executive Officer Jeff Bezos appears determined to show that Amazon can keep bringing in more profit and sales – he pulled back on spending last year to deliver a surprise jump in earnings and will be showing Amazon’s first Super Bowl commercial next week.

Leave A Comment