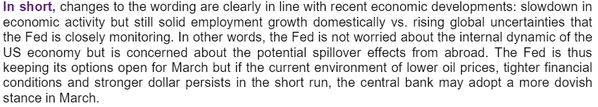

| We begin with the statement from the Federal reserve. Here is a summary interpretation from Natixis. |

|

| Source: Natixis |

| The “monitoring” of international developments was interpreted as somewhat dovish – although depending on how one looks at it, this could just be wishful thinking. Nevertheless the euro and treasuries rallied. |

|

|

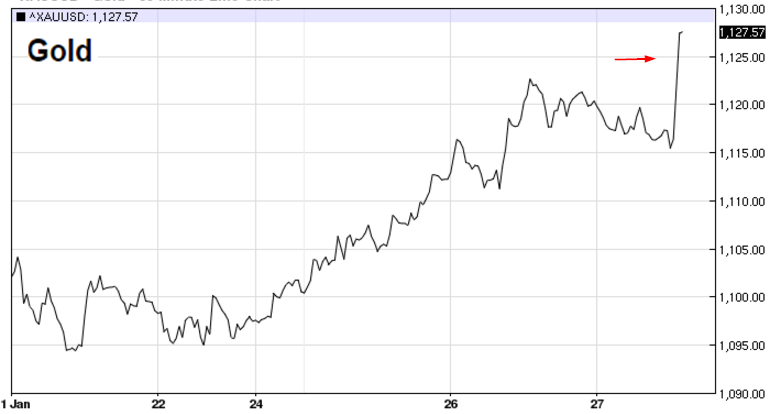

| Gold, which has been moving higher this year, also jumped on the news. |

|

| Source: barchart |

| US equity markets on the other hand were disappointed that the Fed didn’t go far enough, not taking the March rate hike off the table. |

|

| Source: barchart |

| Crude oil was actually higher as stories spread that Russia can’t take it anymore and is pressuring the Saudis/OPEC to implement some production cuts. It’s hard to see this working however with Iran being adamant about ramping production. |

|

| Source: FT |

| Thus we had some divergence between crude oil and equities. |

|

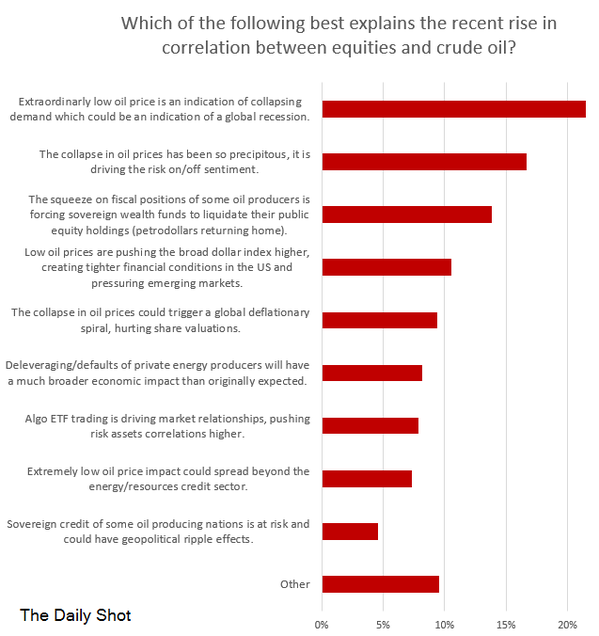

| Regarding this correlation between oil and stocks, here are the results of the Daily Shot survey (about 1k responded). Thanks everyone for participating. |

|

| By the way if anyone is interested in what went into the “other” category, here is a sampling (in alphabetical order). Some responses are quite funny. |

| Page 1, Page 2, Page 3 |

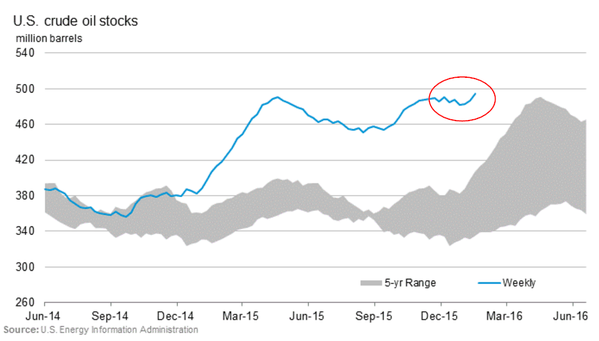

| Staying with the energy markets, here are the latest developments.

1. We hit a new high on US crude oil in storage (almost 500 million barrels). |

|

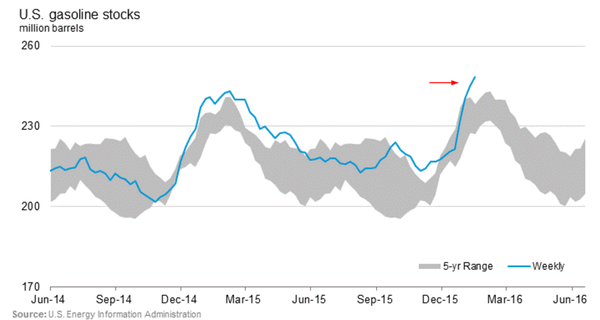

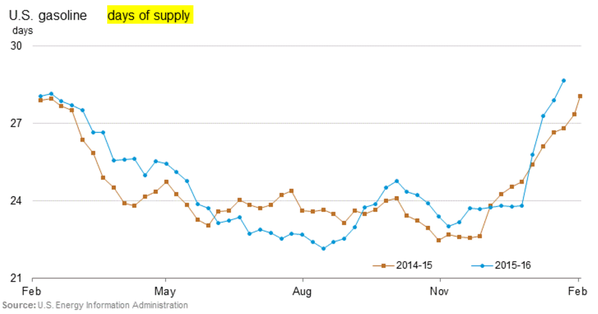

| 2. Moreover, gasoline inventories touched record highs. The fundamentals for crude remain terrible. |

|

|

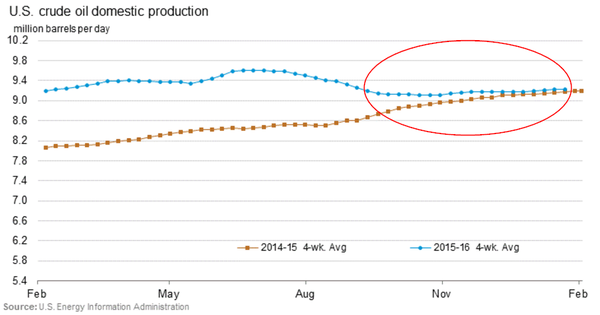

| 3. US crude oil production is still hovering above last year’s. Incredible … |

|

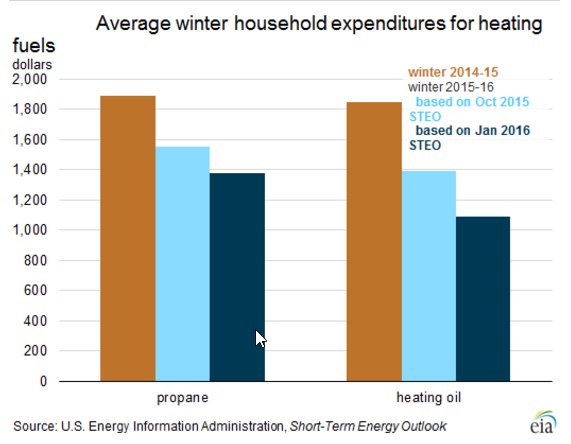

| 4. US consumers are benefiting from lower energy prices and warmer weather. While the media focuses on gasoline prices, this has to add some cash to struggling households. |

|

| 5. Here is how low energy prices are impacting employemnt in oil and non-oil states. |

Leave A Comment