American Express Company (AXP – Free Report) released its 2017 first quarter financial results, posting earnings of $1.34 per share and revenues of $7.9 billion. Currently, American Express is a Zacks Rank #3 (Hold) and is up 2.38% to $77.40 per share in trading shortly after its earnings report was released.

Beat earnings estimates. The company posted earnings of $1.34 per share, beating the Zacks Consensus Estimate of $1.28 per share.

Beat revenue estimates. The company saw revenue figures of $7.9 billion, just topping our consensus estimate of $7.7 billion.

In Q1, American Express saw a 13% decline in net income and 2% drop in revenues year-over-year. While profits and sales dropped, the credit card company acquired 2.6 million new card users globally and “card member spending grew 8%.”

“The results reflect many of the investments we’ve been making to grow the business, plus continued progress in reducing operating expenses,” said Chairman and CEO Kenneth I. Chenault. “Our underlying performance this quarter gives me added confidence in our ability to deliver our 2017 EPS outlook of $5.60 -$5.80 and position American Express for sustainable growth in the years ahead.”

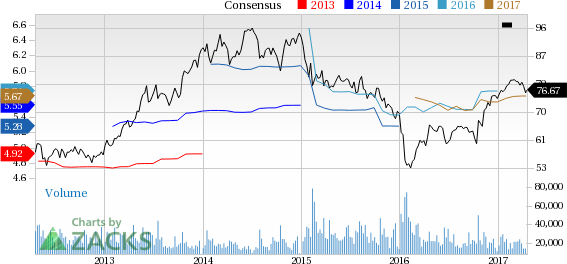

Here’s a graph that looks at American Express:

American Express Company Price and Consensus

American Express Company Price and Consensus | American Express Company Quote

American Express Company is primarily engaged in the business of providing travel related services, financial advisory services, and international banking services throughout the world. American Express Travel Related Services Company, Inc. provides a variety of products and services, including, global network services, the American Express Card, the Optima Card and other consumer and corporate lending products, stored value products, and several others.

Leave A Comment