Today I’d like to share a few words about the Olympics, but first, two words: Don’t panic.

The stock sell-offs last Monday and Thursday were the two biggest daily point drops in the history of the Dow Jones Industrial Average, but in terms of percentage point losses, they don’t even come close to cracking the top 10 worst days in the past 10 years alone.

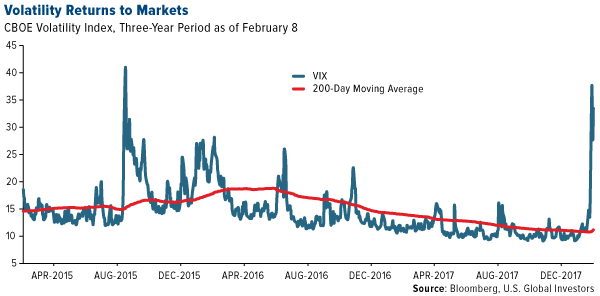

After a year of record closing highs and little to no volatility, it was expected that the stock market would need to blow off some steam. Last Monday, the CBOE Volatility Index, or VIX, surged nearly 116 percent, its biggest one-day increase since at least 2000.

This stoked fears of higher inflation, which in turn raised the likelihood that the Federal Reserve, now under control of newcomer Jerome Powell, will raise borrowing costs more aggressively than expected to prevent the economy from overheating.

Also contributing to the uncertainty was news from the Treasury Department that the U.S. government plans to borrow nearly $1 trillion this year, compared to almost half that last year. In the first quarter alone, the Donald Trump administration will issue $66 billion in long-term debt, the first such boost in borrowing since 2009, as the U.S. Treasury seeks to cover budget deficits brought on by higher entitlement spending, not to mention the recently passed tax overhaul.

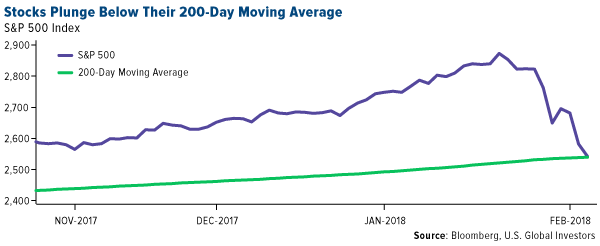

On Friday, the S&P 500 Index briefly plunged below its 200-day moving average before rebounding in volatile trading.

With stocks down more than 8 percent from its closing high on January 26, we’re closing to entering correction territory. Historically, it’s taken from a correction, according to Goldman Sachs analysis. By comparison, a bear market, which is generally defined as more than a 20 percent drop, can take up to two years.

I’m not saying a bear market is imminent—only that it might be time to reevaluate your tolerance for risk and, if appropriate, act accordingly. It’s times like these that highlight how important it is to be diversified in a number of asset classes such as gold, commodities, municipal bonds and international stocks.

Leave A Comment