With the 97.8% of fourth quarter earnings reports for the S&P 500 now in, I can update my quarterly analysis of earnings and estimate trends through the 4th quarter of 2015.

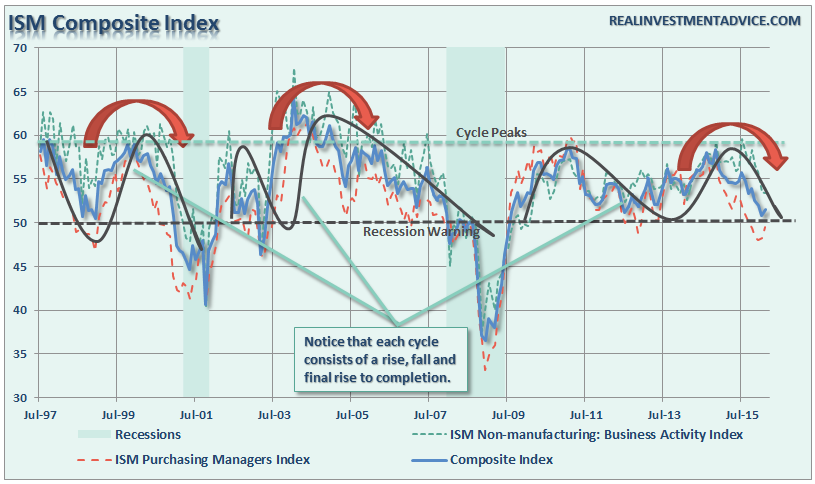

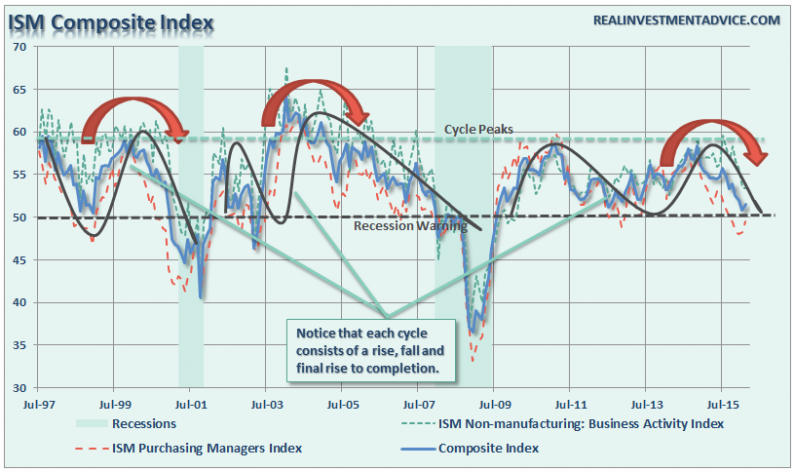

Fourth quarter’s results have continued to deteriorate as activity slows amidst the ongoing global deterioration. While many pundits have tried to suggest “this time is different” because the “service” sector has not fallen into contraction, this may be presumptive as the “trend” of the data suggests this is not the case.

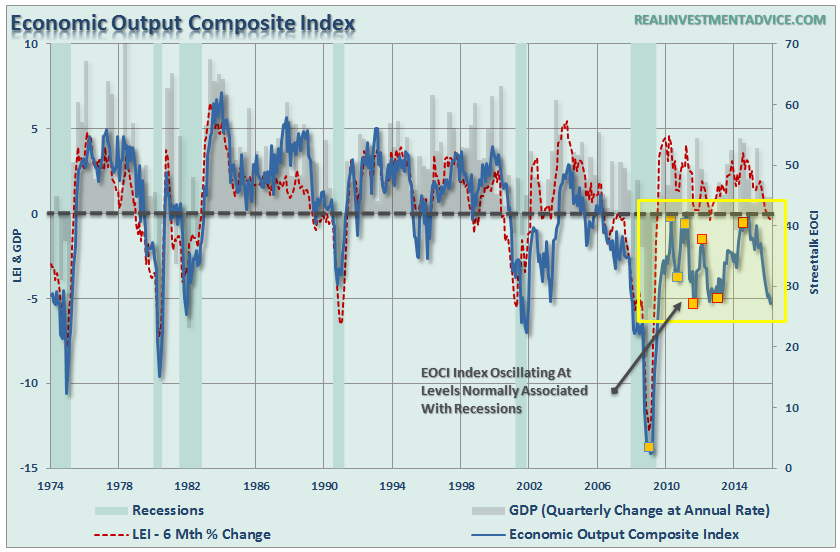

The same can be seen in the Economic Output Composite Index (EOCI) which is comprised of a variety of broad indices including the Chicago Fed National Activity Index, Chicago PMI, several Fed regional manufacturing surveys, ISM composite, NFIB survey and the LEI.

For the quarter, operating earnings fell from $25.44 per share to $23.05 which translates into a quarterly decrease of 9.39%. Of course, operating earnings have all the “crap” in the numbers. More importantly operating earnings FELL have fallen from their peak of $29.60 per share in Q3 of 2014 or 22.13%.

While operating earnings are widely discussed by analysts and the general media; there are many problems with the way in which these earnings are derived due to one-time charges, inclusion/exclusion of material events, share buybacks and accounting gimmickry to “beat earnings.” (For a complete discussion read “The Earnings Season Scandal.”)

Therefore, from a historical valuation perspective, reported earnings are much more relevant in determining market over/undervaluation levels. On a reported basis, earnings declined from $23.22 to $18.63 or 19.77% from the third quarter. But as with operating earnings, reported earnings have fallen an astounding 32.18% from their Q3 peak in 2014.

The decline in both operating and reported earnings for the quarter brought trailing twelve months operating earnings per share to $100.44 which was down from $104.14, a 3.55% decrease. Trailing twelve months reported earnings fell by $4.20 from $90.66 to $86.46, a decrease of 4.63%.

Importantly, the decline in quarterly earnings is consistent with the deflationary and weak economic underpinnings that have been exacerbated by the collapse in commodity prices, particularly oil.

Most importantly, as noted by Dubravko Lakos-Bujas at JP Morgan:

Leave A Comment