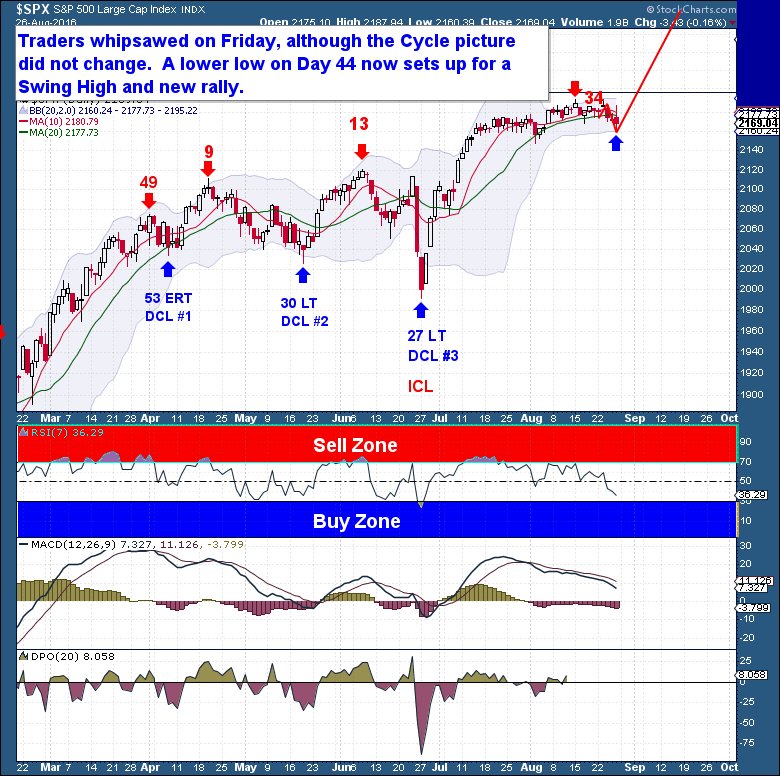

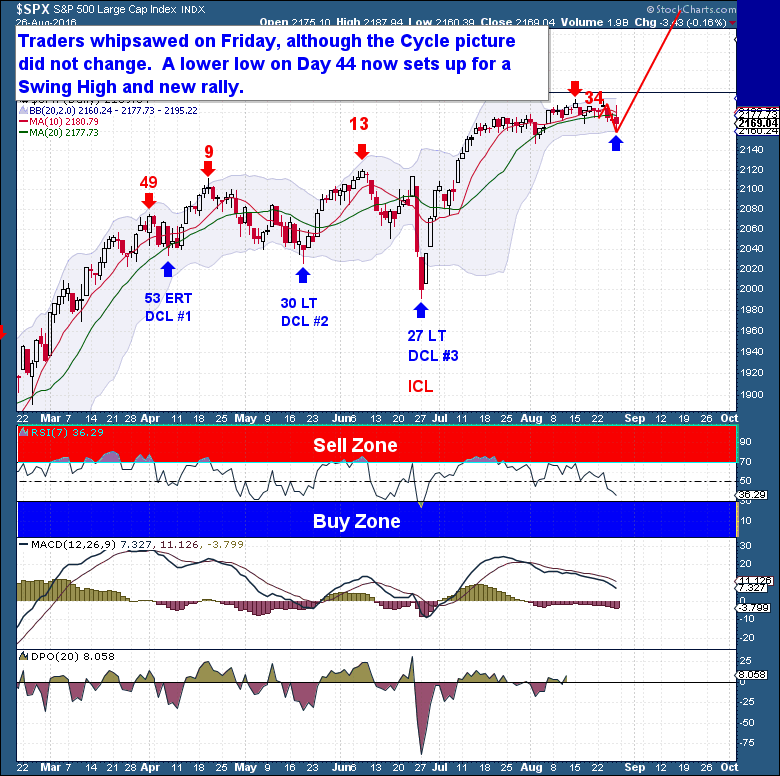

What we know for certain is that the Daily Cycle is well into the timing band for a Daily Cycle Low (DCL), and has reached a new low on day 44. To the naked eye, equities appear poised to move even lower. But from a Cycles standpoint, the S&P is now in a position to move significantly higher.

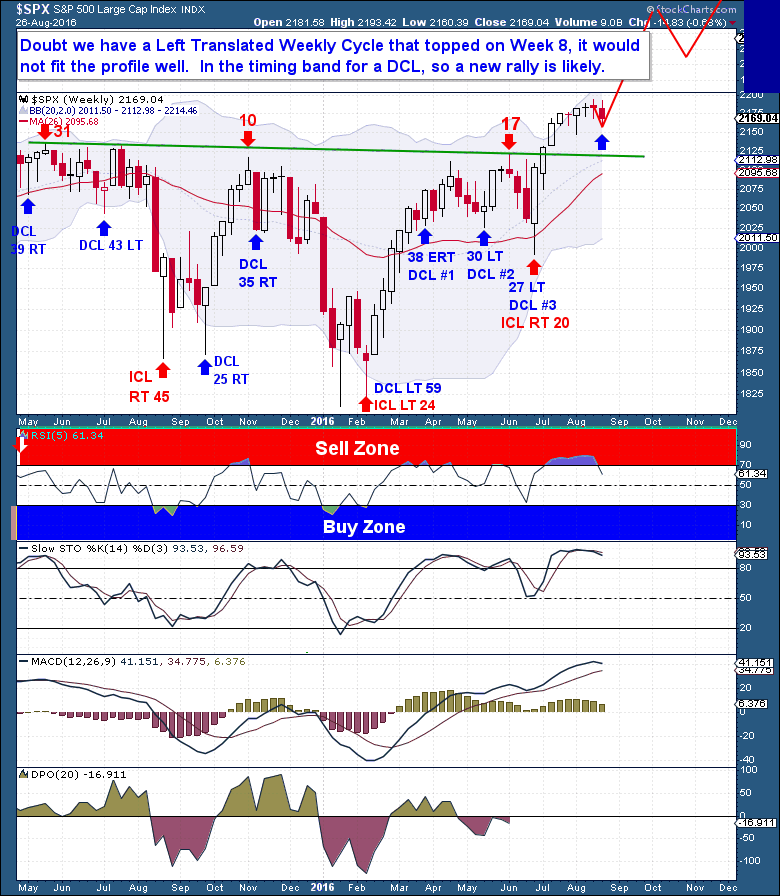

The Investor Cycle outlook is largely the same. The S&P rocketed to a new high from what looked to be the start of a bear market decline in June, and has since (past 4 weeks) been consolidating the gains via time. The S&P now appears ready to move higher again.

Since a new all-time high was made in the current Investor Cycle, it’s really doubtful that the current Investor Cycle(IC) has rolled over, topping on week 8 and continuing a Left Translated IC on the way to its Cycle Low. That scenario simply does not fit the profile of historic equity Cycle performance. Instead, I expect equities to give us a big rally and a Right Translated IC in the coming months.

Leave A Comment