For the world gold community, another great day is underway. The news flow is very solid today, and so is the price of gold itself.

Back in the summer of 2013, most analysts were predicting much higher or much lower prices.

In contrast, I predicted gold would begin a long period of sideways price action. The fundamental drivers of that sideways market that has obviously occurred are a fade in the dominance of the fear trade (system risk) of the West, a rise in the global inflation trade, and a rise in the Eastern love trade.

Many gold analysts wondered if the Millennials in China and India would stop buying gold and focus on useless technology-oriented trinkets instead of gold jewellery.

I was adamant that Chindian Millennials would simply demand new designs for their gold jewellery. I was even more adamant that the overall demand for gold jewellery there would rise by about 6% -8% annually for decades.

That demand growth is in play now, and it’s accelerating. It will ultimately swamp mine supply, scrap supply, and even central bank supply.

While US tariffs are a short-term concern, over the long term it’s absolutely impossible for an American population of about 350 million to compete with 3 billion Chindians. The bottom line:

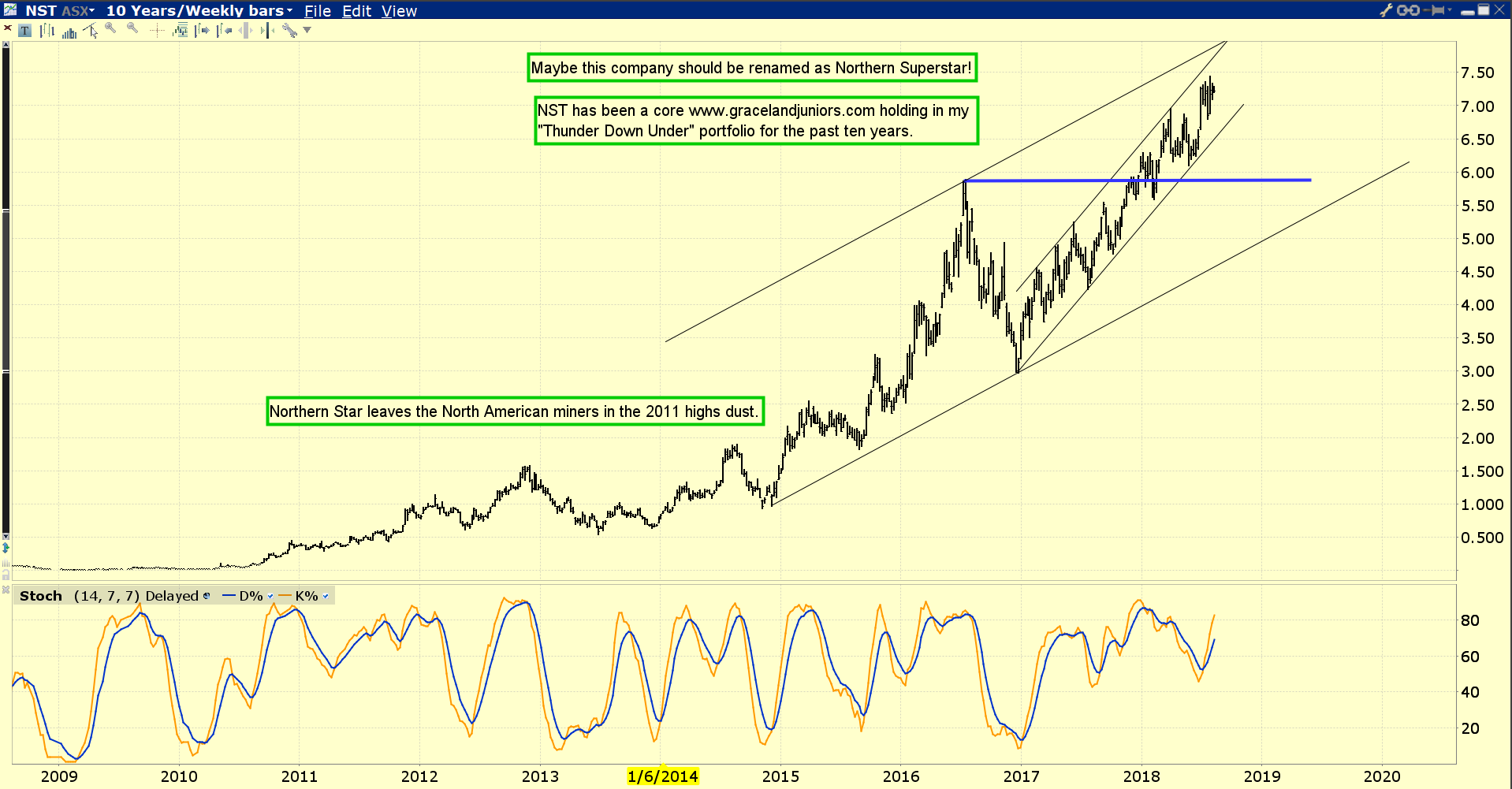

The gold bull era is real and it’s beginning now. Western gold bugs who are maniacally obsessed with buying only North American junior miners can prosper, but it will be a bit of an emotional roller coaster for them.

Simply put: If an investor takes on a lot of risk, they have to accept that both the thrills of victory and the agony of defeat will be experienced repeatedly for a long time.

It’s very important that the new breed of gold investor be well-diversified in all sectors of the precious metals asset class. They need access to the Australian market where the gold and silver miners generally trade with much more stability.

Leave A Comment