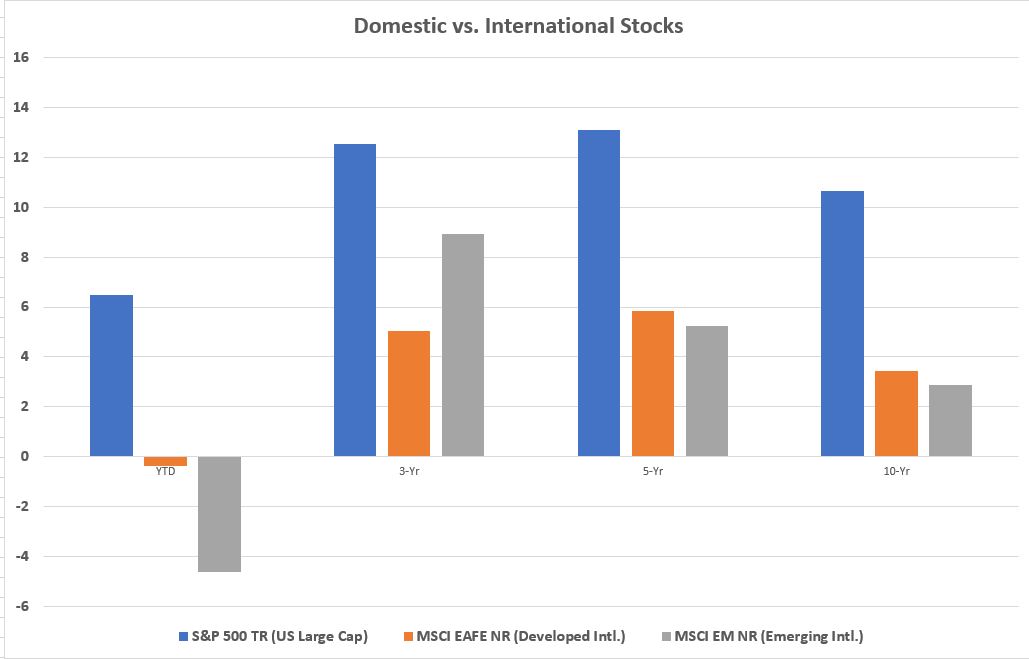

Domestic stocks outperformed international stocks for a long time. On a year-to-date basis, the S&P 500 Index was up more than 6% through July, while the MSCI EAFE (EFA) Index was down slightly and the MSCI EM (EEM) Index was down more than 4%. The international stock returns are after translation to the dollar, so they assume a U.S .investors bought them without using a currency hedge and received the dual return of the stocks in their local markets and the return of the local currency relative to the U.S. dollar.

In every instance (YTD, 3-, 5-, and 10-year periods), the international stocks performed better in their local markets before translation to the dollar. That means the dollar has been appreciating for a while. It has also been appreciating a lot recently.

There have been years over the past decade when international outperformed domestic. Last year was such a year. The S&P 500 produced a 21.83% return, while the MSCI EAFE delivered a 25.03% return and the MSCI EM Index delivered a whopping 37.28% return. But the recent long term has clearly favored U.S. stocks.

In the past emerging markets were said to be “coupled” with the developed world. If the developed world stopped spending, emerging markets suffered greatly. Also, there was coupling in the sense that emerging markets currencies would plunge when the dollar strengthened, and they’d have to spend all their reserves to prop up their currencies. Emerging markets countries borrowed debt in dollars or other developed world currencies, and dollar appreciation put an extra burden on them.

Has decoupling occurred now? Will the dollar’s rise crush emerging markets again, or have things changed? Are emerging markets able to stand alone now? Nobody knows. Clearly Turkey has been on a borrowing binge that it’s paying for now. But it’s not clear that’s the case with other developing countries.

It’s the dollar, stupid

Leave A Comment