115.6% — that’s how much the VIX moved on Monday. And that was all it took to end the life of the VelocityShares Daily Inverse VIX Short-Term ETN (XIV).

And now we have pundits on TV expressing their shock and dismay. Really?!

This is plain silly. It’s worse abuse than shopping for clothes or being stabbed, because a trained monkey could see this one coming.

Even yours truly tried his best to lay it out in simple English all the way back in 2016 (3 times, actually). When warning you, dear reader, that a short squeeze was coming we explained it like this:

Every time you sell volatility you get paid by the counter-party who is typically hedging the volatility (going long) of a particular position and paying you for the privilege. This is not unlike paying a home insurance premium where the insurer takes the ultimate risk of your house burning down and you pay them for the privilege. The difference however between selling volatility in order to protect against an underlying position and selling volatility in order to receive the yield created is enormous. And yet this is the game being played.

The Central banks have managed to create a sense of calm in the markets exhibited by record lows in volatility and for their part Joe Sixpack investor has used linear thinking extrapolated well into the future assuming ever greater risk ignoring market cycles and extremes at their peril.

Two things are happening here:

- When the proverbial house burns down the insurance company (ETF) can’t cover. It’s all in and was never designed to protect holders for the inevitable reversal.

- Investors have been selling volatility in order to achieve yield and thus treating these structured products like bonds, when they are in fact similar to bonds in the same way that the iPhone is similar to a water buffalo.

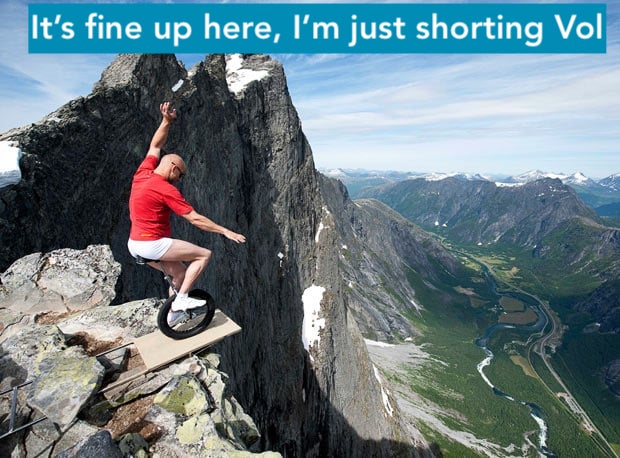

Traders are aggressively hunting for yield and finding it in selling volatility. This works wonderfully…until it doesn’t.

Leave A Comment