The bad news for Argentina keeps coming.

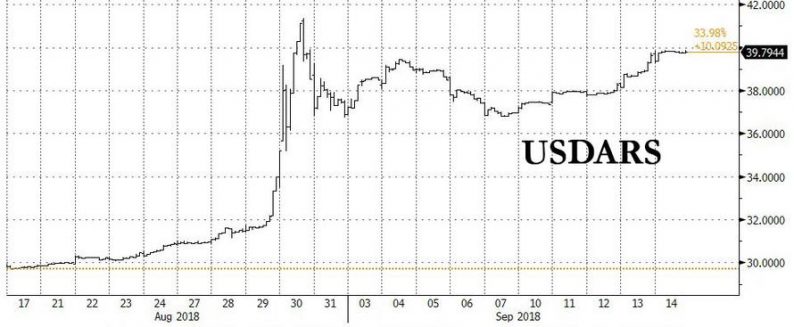

Shortly after a late sell-off pushed the Argentina Peso to a new all-time low on a closing basis, Reuters reported that a $3 billion tranche from the IMF that was supposed to be disbursed to Argentina this month under the country’s bailout deal was postponed while the government hammers out the terms of the standby agreement, the largest in IMF history.

The payment “has been halted until new terms are reached,” said the Reuters source.

With the peso crashing earlier in the year amid fears of a collapsing economy and capital flight, President Macri signed a $50 billion deal with the IMF in June, but he went back to the Fund to renegotiate terms in order to speed up cash disbursements under the agreement. The discussions between Buenos Aires and and the IMF have been ongoing, with the IMF reportedly warning Argentina not to use the funds from the agreement to support the peso.

It is unclear of Argentina has remained in compliance with the request: earlier on Friday the central bank auctioned $200 million in reserves in a bid to stabilize the peso.

Meanwhile, according to Bloomberg, Argentina faces a bleak future no matter what happens: the most likely outcome for the troubled economy is a deep recession followed by political upheaval.

That’s because countries that have seen their currency decline by more than 40% in a year have typically suffered economic contractions of more than 6% the year after. Argentina’s peso is down 53% in the past 12 months.

As Argentina’s government struggles to restore investor confidence, foreign financing has dried up and borrowing costs have soared, stalling investment and undercutting what was already a fragile economy. The only question is how big the recession will be. Moody’s is forecasting a 2 percent decline in each of the next two years, while Fitch Ratings sees a 2.5 percent recession this year, with further contractions possible.

Leave A Comment