Argentinian Peso – Argentina May Default

Emerging market stocks and currencies plummeted further even with the decline in the dollar.

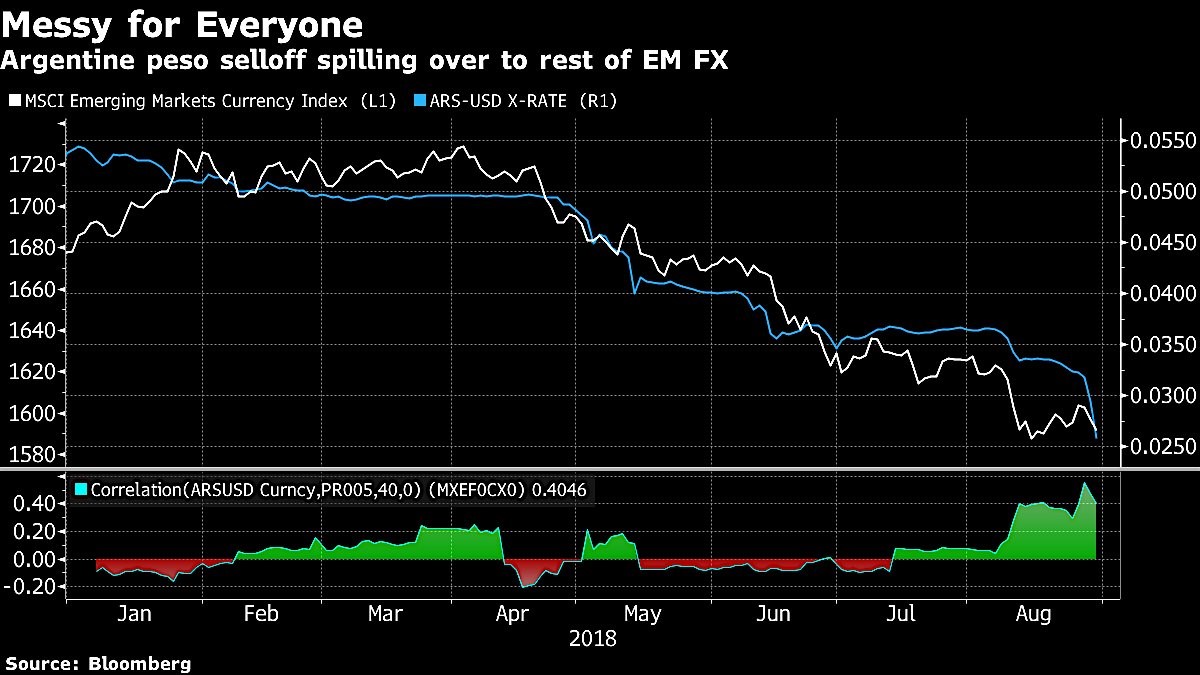

The MSCI emerging market equity ETF fell 2.66% on Thursday. One of the catalysts for the decline was the chaos in Argentina as its central bank hiked rates to 60%.

The country’s inflation rate is 25.4% and the peso is down 45% versus the dollar this year.

With weakness in Venezuela, Turkey, and Argentina, emerging markets are suffering a death by 1,000 cuts.

As you can see from the chart below, the Argentinian peso crisis is spilling over to the rest of the emerging market currencies.

Argentinian Peso isn’t the only one in trouble – Gains Rescinded: Dollar Tree Crashes 15.5%

After a 4 day winning streak where records kept being broken, the stock market finally fell on Thursday. The S&P 500 was down 0.44%.

After the Argentinian Peso crisis, the biggest loser was Dollar Tree. It fell 15.5% on disappointing earnings.

EPS were $1.15 which missed estimates by one cent. Revenues were $5.53 billion which missed estimates by $10 million.

Same-store sales growth was 1.8% which missed estimates by 4 basis points. This is much different from the other great retail earnings reports.

It’s fair to speculate that the economy is so good that fewer people need to spend money at the dollar store. It can be a bad thing that the dollar store is doing well.

As I mentioned in a previous article, the working poor are very optimistic about the economy; maybe they have upgraded from the dollar store to a department store or supermarket.

Argentinian Peso Versus The Dollar – Stocks Are Still Overbought

The VIX was up 10.45% to 13.53. With this small decline in stocks, the CNN Fear and Greed index already fell from extreme greed to greed.

It is now at 73 out of 100. Another couple of down days will push the market away from being overbought.

I am eternally intrigued whether the market conveniently finds reasons to fall when it is overbought or if the news really drives the market.

Leave A Comment