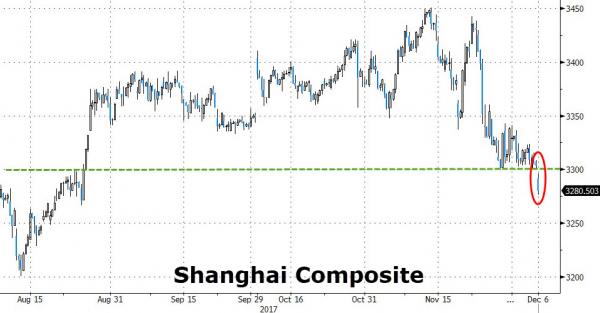

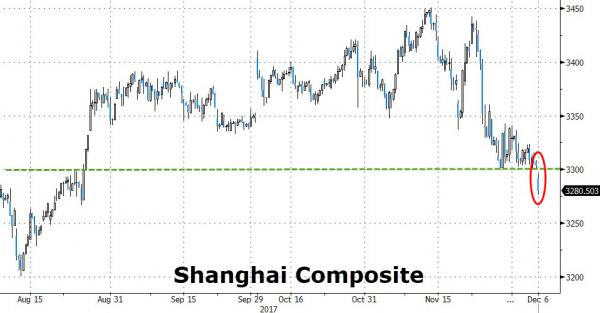

A selloff which started in Asia, driven by renewed liquidation of Chinese and Hong Kong tech stocks and accelerated by weaker metal prices which pushed the Shanghai Composite below a key support and to 4 month lows…

… which sent the Nikkei to its worst day since March and the second worst day of the year, while the overall Asia Pac equity index slumped for the 8th day – the longest streak for two years, spread to Europe and the rest of the world, pushing the MSCI world index lower by 0.3% as investors continued to lock in year-end gains among the best performing assets amid a broad risk-off mood. In FX, the dollar stabilized as emerging-market currency weakness meets yen gains while Treasuries and euro-area bonds gain as focus now turns to efforts to avert a U.S. government shutdown on Saturday. Euro and sterling trade heavy in average volumes while the loonie consolidates before BOC decision.

The VIX was up again in early trading, its eighth day of gains in the last ten sessions as investors grow increasingly jittery about stock markets driven to pricey levels by widespread enthusiasm about the economy.

Investors concerned about high valuations took the top off the tech sector, where stocks such as Facebook, Alphabet, Tencent and Alibaba have reached prices some describe as “eye-watering”.

Quoted by Reuters, Ken Hsia, European equities portfolio manager at Investec Asset Management, said he had shifted positioning this year from tech into other sectors including financials which he thought would gain from higher yields and fiscal shrinking. “Their valuations needed something more heroic in terms of the earnings growth they were reporting, and we sold some and rotated that into other parts of the market,” he said.

“We really don’t see great bargains in any market right now with the U.S. trading at 18.2x price to earnings and 14 percent above its average, and Europe at 15.1x, 10 percent ahead of the average,” said Jefferies analysts in a note.

Asia was broadly lower, with the MSCI Asia index down 1.3% to 167.27 while MSCI Asia ex japan slid 1.5% to 543.05, pressured by a 2% drop in the Nikkei. The MSCI Asia Pacific Index is set to fall for the eighth day, the longest run of losses since 2015, and emerging-market stocks slumped to a two-month low and is nearing a critical 100-DMA support level.

The Shanghai composite recouped some losses, closing down only 0.3%, after the PBoC skipped open market operations for a 4th consecutive day, but lent CNY 188bln via its Medium-term Lending Facility, matching the maturity of a similar maturing facility. Australia’s ASX 200 (-0.4%) weakened with miners dampened in Australia by losses across the metals complex in which gold slipped to near 4-month lows and copper prices slumped, while underperformance was seen in Japan as exporters took the brunt of a firmer JPY. Hang Seng (-1.7%) and Shanghai Comp. (-0.9%) conformed to the downbeat tone after the CBRC signalled further regulation in the financial sector and the PBoC skipped on Reverse Repo operations for a 4th consecutive day, but instead opted for its Medium-term Lending Facility. The Hong Kong market tumbled on Wed, with the Hang Seng sliding 2.1%…

… and the Hang Seng China enterprises index down 2.8%, suffering losses seen across the board, but tech stocks leading the drop again with Tencent sliding another over 2.6%. Earlier, it was reported that Pony Ma, Tencent’s founder, was very interested in AI healthcare companies; it has invested in at least seven companies of the type.

Elsewhere, automaker BYD plunged near 7%, biggest drop in a year.

Japan’s 10yr JGBs were relatively unchanged and failed to benefit from abroad risk-averse tone, while the BoJ’s Rinban operation for JPY 460bln of JGBs concentrated in the belly was also largely ignored.

Europe’s Stoxx 600 Index dropped a second day as technology and basic resource shares declined. European tech shares led the fall, with the sector index (SX8P) the worst-performer in the Stoxx 600. The SX8P has lost more than 5% since Nov. 29, when a broad selloff of large-cap U.S. tech stocks began, with the index now testing a key support level and approaching the 200-DMA. Among biggest decliners on Wednesday are chip stocks AMS, STMicroelectronics and Infineon, which have been among the year’s best performers. U.S. and European technology shares have been falling over the past week amid a widespread rotation from momentum to value stocks, with some investors noting reallocation into financials and industrials, which are seen as more likely to benefit from a U.S. tax cut. That said, Bloomberg notes that some strategists, notably SocGen’s Andrew Lapthorne, say that the size of the tech selloff indicates that computer-driven funds liquidated or readjusted factor exposures.

The MSCI Asia Pacific Index is set to fall for the eighth day, the longest run of losses since 2015, and emerging-market stocks slumped to a two-month low. European bonds followed the U.S. benchmark higher. Sterling weakened as efforts to rescue Brexit talks prompted fresh divisions in the U.K. Cabinet. The euro drifted even as an unexpected rise in German factory orders showed Europe’s largest economy will carry its strong momentum into 2018.

Copper prices recovered slightly in early London trading, up 0.1 percent having hit a two-month low, but European mining stocks .SXPP fell 1.1 percent.

As Bloomberg notes, global markets have succumbed to a bout of profit taking as traders move out of some of 2017’s biggest winners, including technology shares and emerging-market equities. The selloff comes as investors assess U.S. tax reform developments and wrangling over the American debt ceiling after a Republican plan to avoid a federal shutdown on Saturday were thrown into disarray by infighting. Investors are “locking in profits earlier than usual for the year and not opening any new positions,” said Andrew Clarke, director of trading at Mirabaud (Asia) Ltd. “Eventually, as profit taking subsides, buying for the new year will appear as people look toward 2018.”

In the ongoing Brexit saga, DUP Party says no plans for a phone call between its leader Foster & UK PM May today. However, it was later reported that UK PM May had been speaking to DUP Party leader Foster. Overnight we also got reports that PM Theresa May is reportedly facing cabinet revolt led by Boris Johnson and Michael Gove over concerns she is forcing a soft Brexit. Similar reports in the Guardian stated that Brexit supporters in May’s top team would object if they believed that anything was agreed that could limit the UK’s ability to diverge from the EU in the future.

Leave A Comment