“Once upon a time Charles Dickens said in A Tale of Two Cities “It was the best of times, It was the worst of times”. That is something that is indicative of all the rating agencies.”

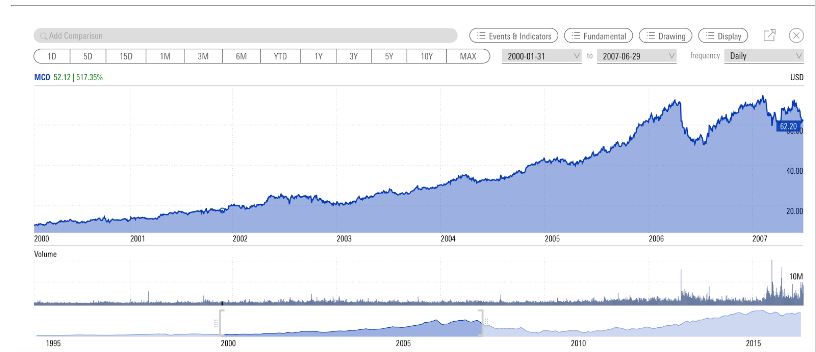

The year is 2001 just after the tech bubble, and some stocks have begun to regain favor again as the stock market recovers. One that did very well was Moody’s Corporation (MCO). It was spun off in 2000 at the very end of the dot com bubble by Dun & Bradstreet Corporation, which was fortunate as it could have seen its market cap cut in half had it gone public earlier.

There was a continued need for its services, which are mainly credit ratings, and analytic services pertaining to both equities and bonds. But as its business grew, so did the reliance on its ratings to curry favor with investors. By 2006, “The Big Three” had helped give a higher rating to both asset backed and mortgage backed securities even though the risk associated with these instruments was very high leading to the subprime mortgage crisis, which in turn would help set the stage for the 2008 financial crisis. It was a two-way street: the ratings agencies loved the business they were getting, so they continued to rate the securities; and the companies needed good ratings from these agencies so that investors would invest, so they did large amounts of business with them.

To this day, many still have a bad taste in their mouth when talking about the ratings agencies, but times have changed. Heavy regulations following the crash have made it very hard for companies like Moody’s to repeat the same mistakes again.

Moody’s has a tremendous moat operating with only 2 main competitors (Fitch & S&P) that together make up all of the revenues accounted for by ratings agencies in the United States.

Last year Moody’s reported revenues of $3.5B. The company has strong margins as you might imagine because Moody’s’ products are all services (low overhead: no storage costs, no shipping costs, no amortization of inventory, etc.) Therefore, strong operating cash flow for the company equals strong free cash flow, which ultimately equals strong capital returns to shareholders. While this 19.5B dollar company has been increasing its dividend (now up to 1.5%) and growing its margins, this quarter’s results are set to be bleak. For the first three months of 2015 the company had a net income of $231M as opposed to $187M this year.

Leave A Comment