When it comes to safe and consistent dividend growth, few companies have done it better than the dividend aristocrats, S&P 500 companies with 25+ consecutive years of payout increases under their belt.

Of these impressive dividend growers, AT&T (T) stands tall above all the rest with a 5.9% dividend yield. When combined with the company’s 33 straight years of dividend increases, AT&T could deserve consideration as one of the best high dividend stocks.

One of the reason’s AT&T’s yield is so high is because the company’s stock price has dropped by more than 15% over the past month. That’s a surprisingly big move for a stock that is held by most investors for its safe income and defensive qualities.

With concerns growing over AT&T’s pay-TV subscriber losses, uncertainty over the Time Warner (TWX) merger gaining final regulatory approval, and the company’s massive debt burden, some of the stock’s underperformance seems justified.

Let’s take a closer look at the issues affecting Ma Bell to see if the stock’s dividend yield, which sits near its highest level since 2011, appears to be attractive for a diversified income portfolio or is instead a sign that AT&T is becoming a value trap.

Business Overview

Founded in 1983 as SBC Communications (the company bought AT&T in 2005 and adopted the more famous moniker), AT&T is a telecom and media conglomerate that operates four business segments:

Business Solutions (43% of 2016 sales): offers wireless, fixed strategic, legacy voice and data, wireless equipment, and other services to over 3 million business, governmental, and wholesale customers, as well as individual subscribers.

Entertainment (31% of 2016 sales): provides video entertainment and audio programming channels to approximately 25.3 million subscribers; broadband and Internet services to 12.9 million residential subscribers in over 240 markets; local and long-distance voice services to residential customers, as well as DSL Internet access services. This division has connections to over 60 million locations nationwide.

Consumer Mobility (20% of 2016 sales): offers wireless services to over 136 million U.S. customers and wireless wholesale and resale subscribers, such as long-distance and roaming services, on a post and pre-paid basis.

This segment also sells a variety of handsets, wirelessly enabled computers, and personal computer wireless data cards through company-owned stores, agents, or third-party retail stores, as well as accessories, such as carrying cases, hands-free devices, and other items.

International (4% of sales): offers digital television services, including local and international digital-quality video entertainment and audio programming under the DIRECTV and SKY brands throughout Latin America. This segment also provides postpaid and prepaid wireless services to approximately 13.1 million subscribers under the AT&T and Unefon brands; and sells a range of handsets.

Business Analysis

The key to AT&T’s ability to generate such high and growing dividends over time is the wide moat created by the extremely capital intensive nature of the industries in which it operates.

For example, AT&T spent more than $140 billion between 2012 and 2016 on maintaining, upgrading, and expanding its networks, including over $22 billion in 2016 (13.4% of revenue).

Few other companies can afford to compete with AT&T on a national scale. Only Verizon (VZ), T-Mobile, and to a lesser extent Sprint (S) have the resources to operate networks that offer similar levels of connectivity.

To make matters even more challenging for new competitors, most of AT&T’s markets are very mature. The number of total subscribers is simply not growing much.

In other words, it would be almost impossible for new entrants to accumulate the critical mass of subscribers needed to cover the huge cost of building out a cable, wireless, or satellite network.

In addition to covering network costs, AT&T’s scale allows it to invest heavily in marketing and maintain strong purchasing power for equipment and TV content. Smaller players and new entrants are once again at a disadvantage.

Barring a major change in technology, it seems very difficult to uproot AT&T. It’s much easier to maintain a large subscriber base in a mature market than it is to build a new base from scratch.

While AT&T’s wireless division is its most consumer-facing business, the company’s strong presence in hundreds of broadband internet markets, as well as its expansion into pay-TV, via the $67 billion acquisition of DirectTV in 2015, have helped it continue growing despite a highly saturated U.S. market in both wireless and internet service.

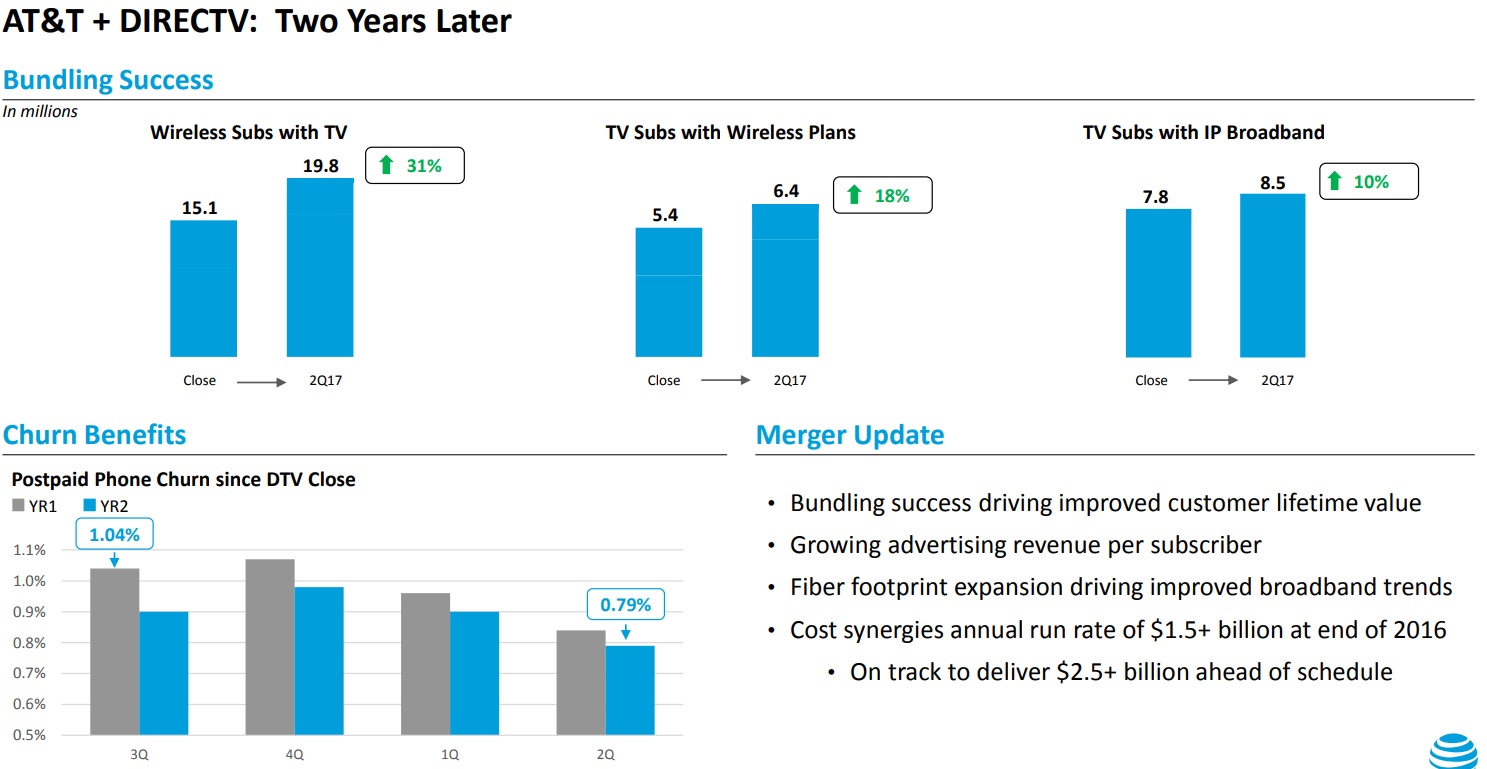

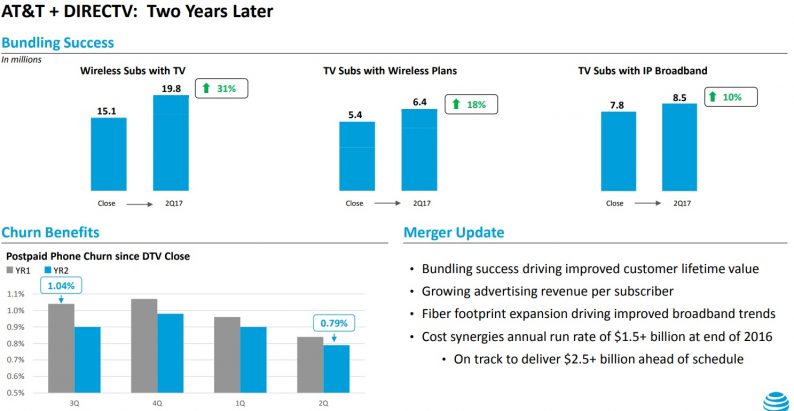

Source: AT&T Earnings Presentation

In addition, DirectTV has allowed AT&T to bundle many of its offerings to customers, helping it fend off the worst of the cord-cutting trend that has plagued so many of its rivals.

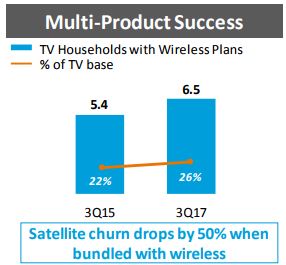

In fact, AT&T showed continue improvement in phone churn and has seen satellite churn drop by 50% when bundled with wireless. More of its pay-TV customer base is also using the company’s wireless plans compared to two years ago.

Source: AT&T Earnings Presentation

With plans to acquire Time Warner, the media content juggernaut, in an $109 billion mega-acquisition (including debt), AT&T hopes to better leverage its various platform offerings to remain competitive in the cutthroat wireless industry.

For example, thanks to T-Mobile reviving the popularity of unlimited data plans, once price insensitive rivals such as Verizon have been forced to reduce their wireless plan prices to $80 per month for unlimited data (first line).

In contrast, AT&T offers a $90 unlimited plan that continues to gain subscribers thanks to the company bundling a $25 pay-TV discount, as well as offering free HBO (a Time Warner company).

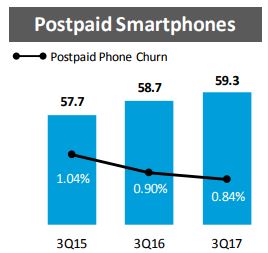

In fact, thanks to the popularity of these bundled unlimited data plans, AT&T’s postpaid churn rate (what percentage of subscribers leave each month) hit a record low for the third quarter of 0.84%, and the wireless segment’s EBITDA margins have risen to a record high of 42%.

In other words, AT&T’s track record of expanding into media and related industries appears to be bearing some fruit, including hitting its synergistic cost saving targets and leveraging its new platforms and properties to strengthen its existing core offerings.

Leave A Comment