The Australian dollar “hugged” the 0.76 for quite some time before slipping a bit lower. The Reserve Bank of Australia convenes soon. What’s next?

Here is their view, courtesy of eFXnews:

We now see a more compelling case for the RBA to begin normalizing policy next year taking into account stronger-than-expected GDP data and improved economic prospects. There has been a notable change in tone from the RBA this year as downside risks have abated. The Bank’s confidence that the GDP would rebound from a weak reading in 3Q has been justified. We now see growth moving above trend into 2018 and look for inflation to get back into the target band faster than previously thought.

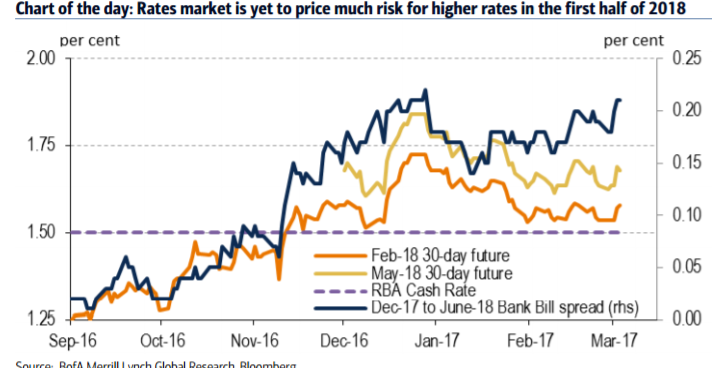

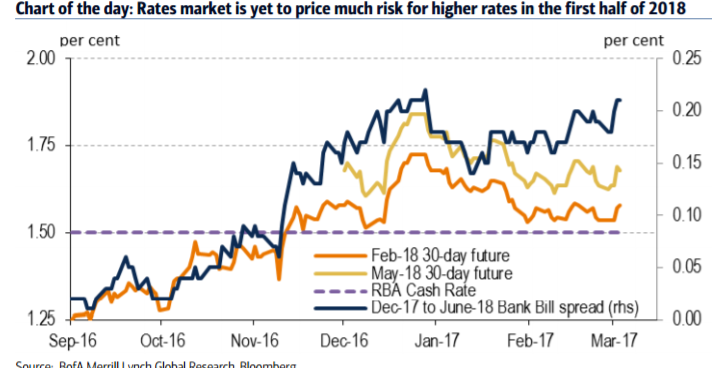

So we have penciled in the start of a move to normalize policy in February and August 2018 that would unwind the two rates cuts seen over 2016.

However, it is too early to expect any guidance from the Bank that a shift in bias is imminent when the board meets this week. Inflation is still below the band and wages growth remains weak. We do not see inflation threatening the inflation target at this stage, but risks are likely to become more balanced to justify winding back stimulus. Policy would still be accommodative. The RBA confirmed our view that the trade-weighted exchange rate is no longer overvalued.

Policy normalisation will support AUD/USD in 2018 but not before a decline toward 0.70 later this year driven by a stronger USD and weaker China data.

Leave A Comment