In the short term, any setbacks in the market are likely to be met with buying interest, as numerous traders are looking to establish long positions in the Australian dollar.

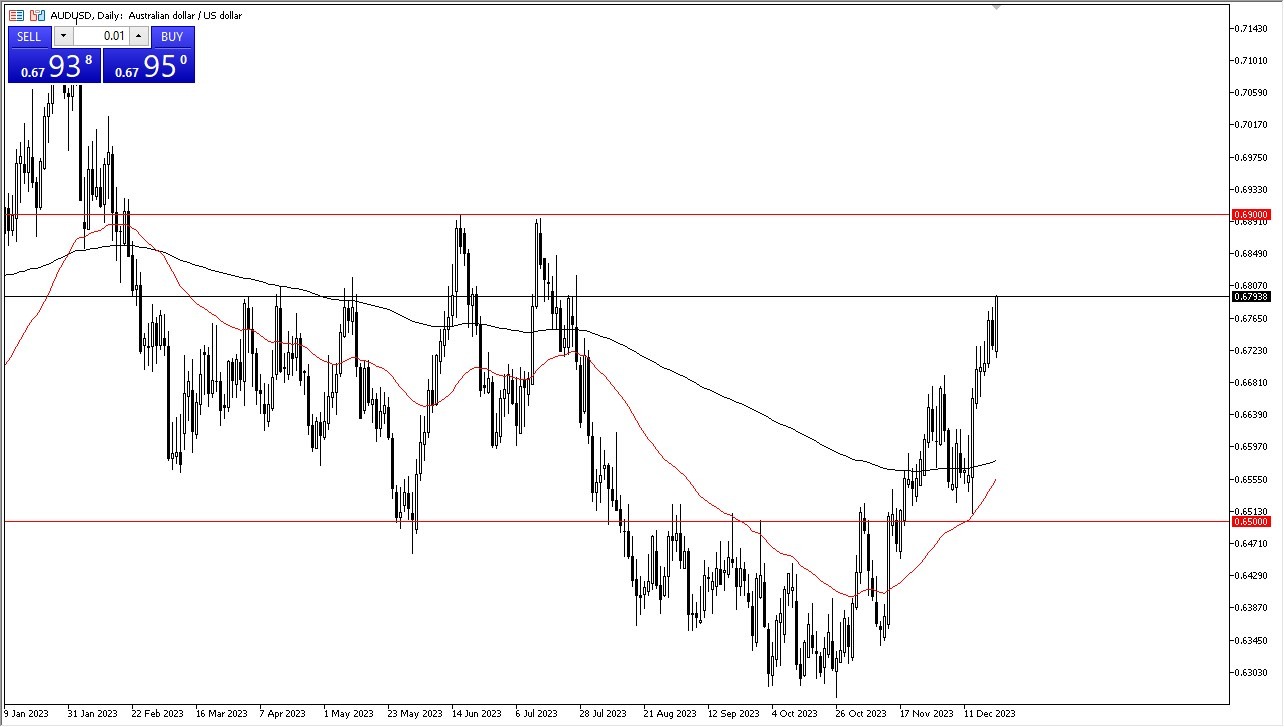

Effective position sizing is essential in these circumstances. At present, the prevailing trading direction for this market seems to be towards the upside. I believe that as time goes on, buyers will step in during price pullbacks, making these dips an opportunity to acquire Australian dollars at a more favorable price point. In the event of a downward shift, the first support level to watch is at 0.67, followed by the 200-Day Exponential Moving Average. Golden CrossSpeaking of moving averages, the 50-Day EMA is currently attempting to surpass the 200-Day EMA, which is often referred to as a “golden cross.” Longer-term traders tend to closely monitor this signal, even though it’s generally considered a lagging indicator. However, it is worth noting that this is a market that continues to see a lot of reasons to think that the pair will go higher over the longer term.In the short term, any setbacks in the market are likely to be met with buying interest, as numerous traders are looking to establish long positions in the Australian dollar. Furthermore, it’s anticipated that interest rates in the United States will continue to decline, reflecting signs of economic weakness. This can potentially influence the direction of this currency pair, as well as anything else denominated in the US Dollar.In the end, it’s advisable to approach this market with a focus on identifying valuable opportunities while keeping in mind that the 0.69 level represents a significant resistance barrier that would take a lot of momentum to break above. The possibility of breaking above this level remains uncertain. Additionally, we are entering the holiday trading season, which can introduce a degree of unpredictability. Nevertheless, the prevailing trend appears to favor this particular currency pair, indicating a potential continued upward trajectory.  More By This Author:Crude Oil Forecast: Markets Show HesitationUSD/CHF Forecast: Struggles Against the Swiss FrancUSD/JPY Forecast: Fights Against the Yen

More By This Author:Crude Oil Forecast: Markets Show HesitationUSD/CHF Forecast: Struggles Against the Swiss FrancUSD/JPY Forecast: Fights Against the Yen

Leave A Comment