After Australia’s Consumer Price Index disappointed the markets, AUD/USD confirms below the Ichimoku cloud, forming a Doji Candlestick pattern. Here is a quick IDDA overview to help you develop a trading strategy for our mate Down Under as traded versus Ms. USA.

1- Technical Points

Daily Time Frame: For new Invest Divas here let me explain that Technical Analysis is the first step in IDDA approach to developing a trading strategy in forex. We are going to start by looking at the daily chart today, as the AUD/USD confirms below the daily Ichimoku cloud. This is especially significant because the pair also confirmed below the 38% Fibonacci level at 0.7526. After the confirmation, however, the paired formed a Doji Candlestick pattern on Thursday. The pair opened Friday’s Sydney session in the pivot zone, between 0.7450 and 0.7526.

AUD/USD Confirms Below Ichimoku Cloud, Forms Doji – Daily Chart

Other points of the Ichimoku analysis have yet to confirm.

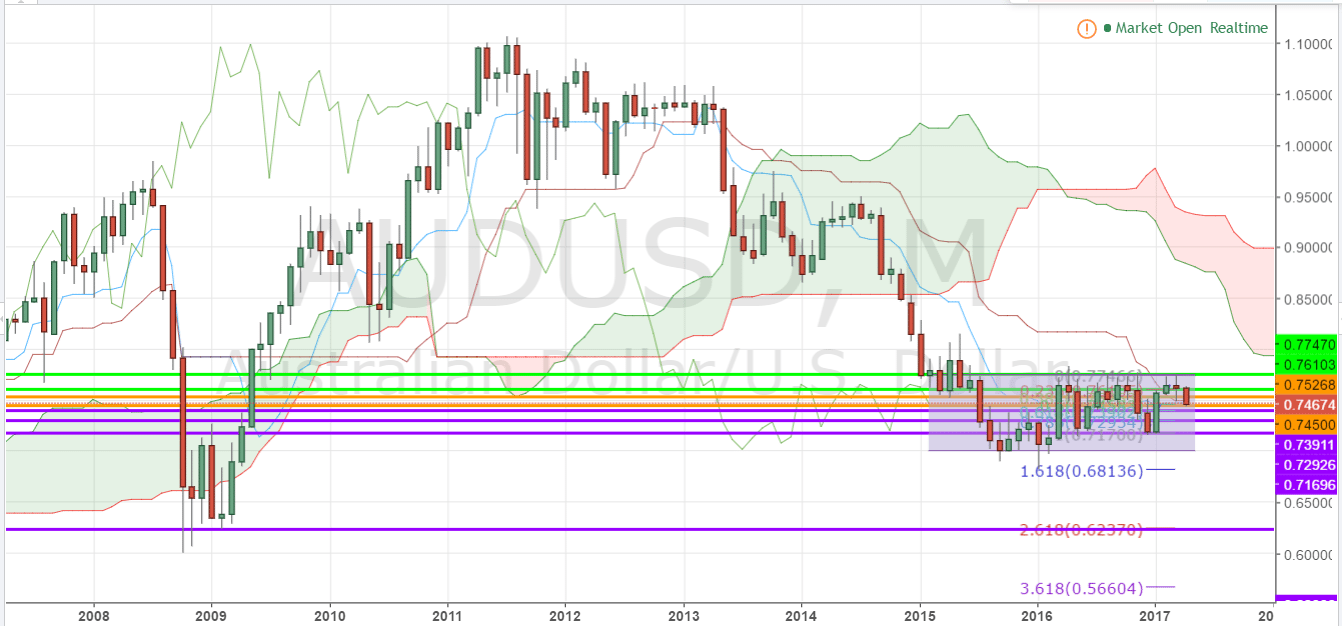

Monthly Time Frame: A quick look at the monthly chart reveals that the pair has been ranging 0.7610 and the 0.70 level for almost two years. It has remained below the monthly Ichimoku cloud. And it could be in the middle of completing a Saucer Top chart pattern.

AUD/USD Confirms Below Ichimoku Cloud – Monthly Chart

The key long-term support is all the way down at the 0.62 level.

2- Fundamental Points

Fundamental analysis is the second step in IDDA approach to developing a trading strategy in forex. We look at the respective currency’s country’s economy and political developments to help with our trading decision.

Aussie Side: The Reserve Bank of Australia (RBA) released their April’s meeting minutes last week. It revealed their members aren’t as upbeat about the economy as we thought they were.

Then this week, the annual rate of inflation came in above 2% for the first time in two years. Following the business cycle, this normally would mean that the central bank should be looking to raise interest rates in order to deal with high inflation. However, economists say the Reserve Bank won’t be looking to raise interest rates anytime soon.

Leave A Comment