The Australian dollar managed to climb and hold onto the 0.76 handle. What’s next as we await the RBA?

Here is their view, courtesy of eFXnews:

The broad retracement of US dollar strength in January reflecting increased protectionist steps by the Trump administration in the early stages of his presidency explains a good portion of the rebound in AUD/USD.

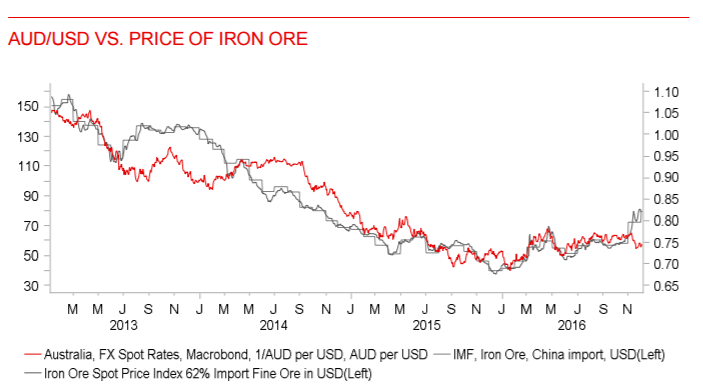

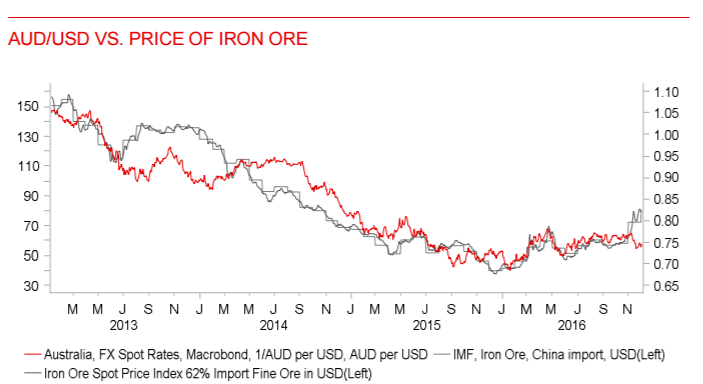

Optimism over improved global growth prospects have also been maintained which helps support the Australian dollar as well. That’s evident by the price of iron ore, which closed January close to recent highs over USD 83 and close to 50% higher since October when the current rally began. But while the global picture currently is supportive for the Australian dollar, domestic factors are likely to continue weighing on AUD/USD.

The key event in January was the release of the Q4 inflation data that pointed to continued weak inflationary pressures that at the very least ensures a shift in monetary stance toward lifting rates remains a long way off. After four consecutive months of short-term yield increases, the weaker inflation resulted in a modest retracement in yields that points to limited upside for the Australian dollar from here.

Given our view that China growth is set to decelerate this year, we are also not expecting further notable advances in commodity prices generally. With the RBA side-lined and with the Fed set to raise rates at least on two occasions this year, we continue to expect offsetting forces (global reflation / policy divergence) to result in a relatively narrow trading range for AUD/USD implying that any notable moves, like that in January, are unlikely to be sustained.

Leave A Comment