It’s different this time… The last two times that Fed hike probabilities (and thus timing of liftoff) surged, the long-end of the bond market rallied (suggesting a premature hike would slow the economy medium-term). The last few days, since The FOMC Statement, Treasury yields have surged (with the short-end underperforming) as 10Y tops 2.25% and 30Y nears 3.00%. As BofAML noted, “if The Fed hikes rates and the long end yield tumbles, that means policy failure,” and so we suspect, in all its confirming-bias perfection, the long-end is being sold to ‘convince’ the world that The Fed is right to raise rates.

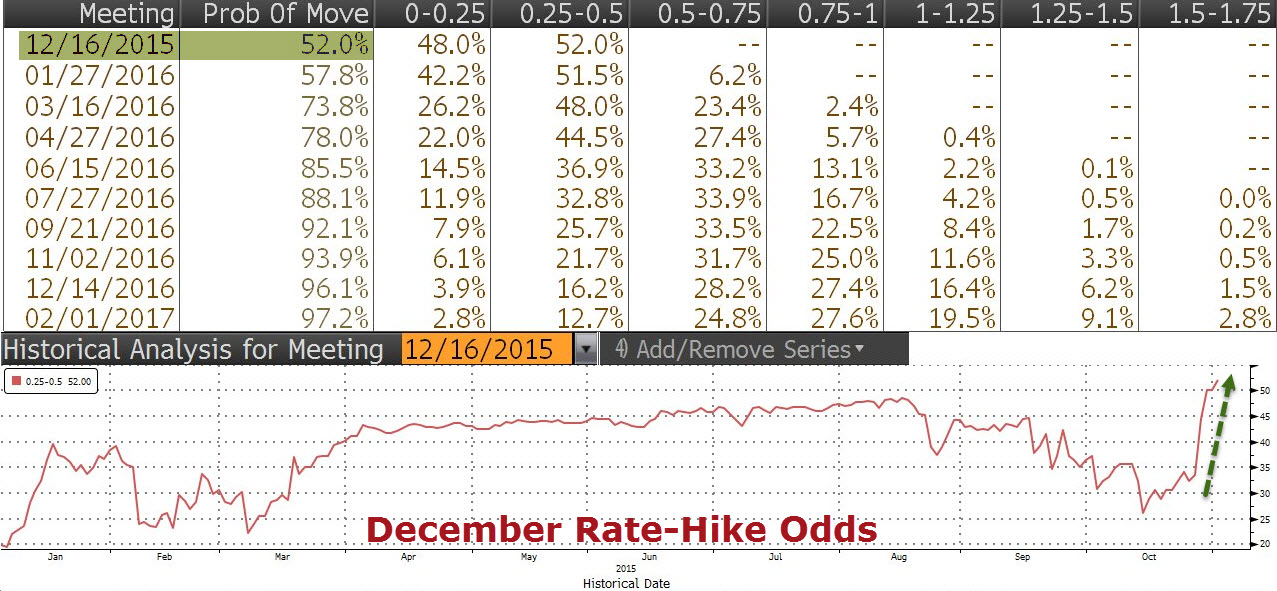

December rate hike odds have surged to series highs…

And Treasury yields have soared, with the short-end underperforming… (notice 30Y actually rallied on the hawkish Fed before ripping higher in yield – on rate-lock chatter amid huge issuance)…10Y back above 2.20% (highest since 9/17) and 30Y nears 3.00%

And notice that in July and again in September, as rate-hike odds rose (and liftoff timing approached) bonds rallied, this time, however, they are selling off…

Must make sure everyone “believes” this time…

Charts: Bloomberg

Leave A Comment