|

Currency

|

Last

|

High

|

Low

|

Daily Change (pip)

|

Daily Range (pip)

|

|

USD/CAD

|

1.3357

|

1.3426

|

1.3343

|

45

|

83

|

USD/CAD Daily

Chart – Created Using Trading View

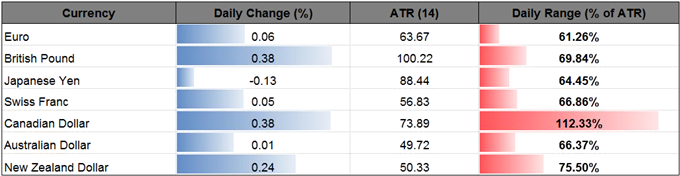

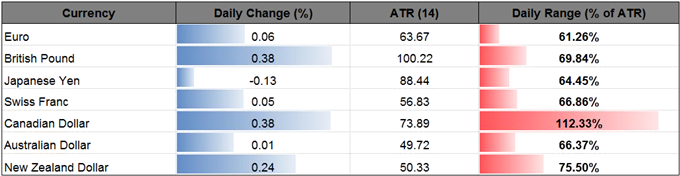

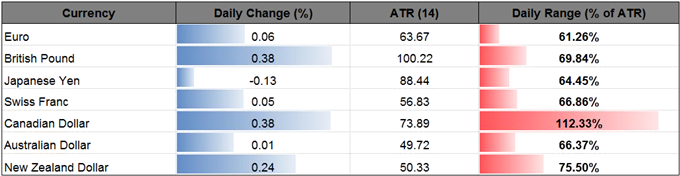

The Canadian dollar continues to outperform against most of its major counterparts, with USD/CAD at risk of test the lower bounds of its recent range amid the ongoing improvement in Canada Employment; will keep a close eye on the Relative Strength Index (RSI) ahead of the Bank of Canada’s (BoC) interest rate decision on April 12 as the oscillator appears to be reacting to former trendline support.

Even though the BoC warns the ‘Bank’s three measures of core inflation, taken together, continue to point to material excess capacity in the economy,’ signs of a stronger labor market paired with the 253.7K print for Canada Housing Starts may push central bank officials to drop their dovish tone as the gauge for building activity marks the highest reading since 2007; at the same time, the recent pickup in oil may become a growing concern as the stickiness in crude prices raises the threat of second-round effects on the real economy.

Nevertheless, Governor Stephen Poloz appears to be in no rush to lift the benchmark interest rate off of the record-low as the central bank head warns against normalizing monetary policy prematurely; in turn, more of the same from the BoC may limit the downside risk for USD/CAD especially as the Federal Reserve appears to be on course to implement higher borrowing-costs over the coming months.

With USD/CAD still capped by the Fibonacci overlap around 1.3450 (23.6% retracement) to 1.3460 (61.8% retracement), the first downside hurdle comes in around 1.3280 (50% retracement) to 1.3310 (38.2% retracement), which coincides with the April low (1.3295), followed by 1.3200 (61.8% retracement).

Leave A Comment