Fundamental Australian Dollar Forecast: Bearish

The Australian Dollar spend last week at the mercy of broader global economic sentiment and it’s all too likely to remain there in the coming sessions even though they will offer Australia watchers a wealth of economic cues.

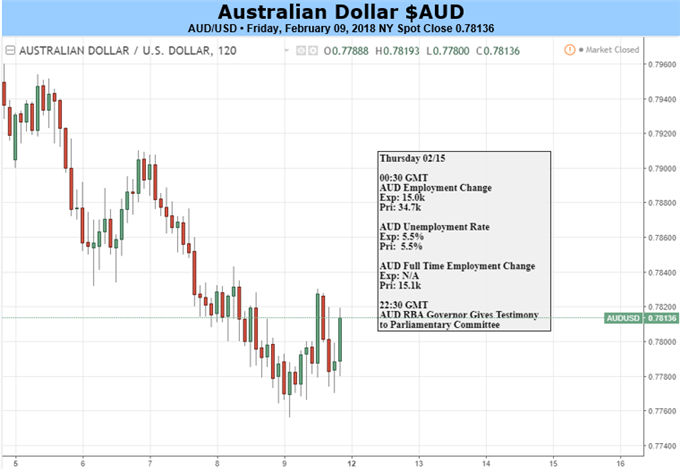

Fairly or not, periods of global risk aversion and market volatility tend to weigh on the Aussie. It’s firmly classed as an asset with a strong correlation to global growth, along with equity. That being so it’s probably not surprising that we should find it close to six-week lows against its American cousin after a week which saw equity markets worldwide under some strain.

It’s not easy to say exactly what caused investors’ sudden rethink about an asset class which previously seemed so well supported. There are any number of possible candidates; fear of rising US interest rates, the possibly re-emergence of inflation or worries that stock valuations were getting ahead of likely reality. Take your pick.

But stocks were pressured and, as a ‘risk asset’ the Aussie was too.

This can sometimes seem a little harsh because the Australian economy is doing reasonably well. The Reserve Bank of Australia evinced cautious optimism when it held interest rates at their record lows last week and, subsequently, in its quarterly policy statement. Business confidence is up, employment levels are rising and even long-dormant consumers are starting to fizz. Wage growth and inflation remain perhaps puzzlingly low, as they do in many other developed economies. Were they to pick up its unlikely that higher Australian interest rates would remain the distant prospect they now are.

Leave A Comment