According to Edmunds.com, in June 2017 the average length of a new vehicle loan has been stretched to a record 69.3 months. JD Power says that incentives last month were running at more than 10% of MSRP, the eleventh time over the past twelve months where manufacturers have so heavily discounted. And yet, the auto industry would have us believe that the problem is one of fleet sales rather than of consumers.

“U.S. total sales are moderating due to an industry-wide pullback in daily rental sales, but key U.S. economic fundamentals clearly remain positive,” said GM chief economist Mustafa Mohatarem. “Under the current economic conditions, we anticipate U.S. retail vehicle sales will remain strong for the foreseeable future.”

Because one segment is weaker than the other does not necessarily mean that both aren’t weak. By “economic fundamentals” GM’s economist is surely referring to the unemployment rate, the a variable that has yet to prove itself in projecting the right economic trend. Retail spending on automobiles for the first half of 2017 is expected to be down 1% from the same six months in 2016. That’s not a good cyclical indication, even more concerning when factoring the incentive aid as well as loan jiggering to make payments as low as possible.

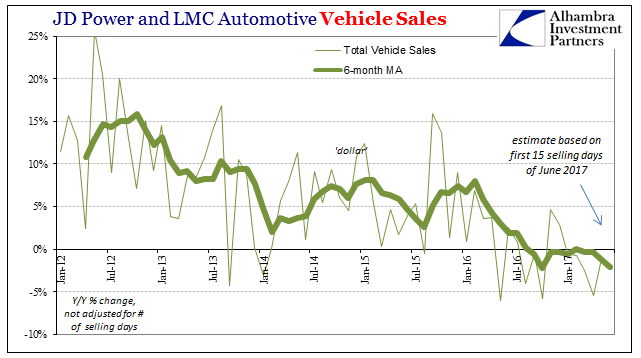

The auto segment is perhaps the sharpest cyclical signal of the US economy right now. Vehicle sales and finance escaped the 2012 slowdown largely on trend, remaining one of the few actually strong parts of an otherwise faltering “expansion.” It wasn’t until the full effects of the “rising dollar” that consumers, as well as fleet customers, finally pulled back – not into recession but at least of sudden caution.

For the month of June 2017, the (mostly) domestic carmakers reported another down comp: Ford -5% year-over-year; GM -4.7%; FCA -7.4%. The results from foreign manufacturers were only marginally better: Toyota +2.1%; +2.0%; Nissan Honda +0.8%. Almost all of the declines are due to car sales. Light trucks and SUV’s have sold better over the last few years, but not nearly enough to fully offset the sudden consumer distaste for cars. And now truck sales have in 2017 been pressured, too.

Leave A Comment