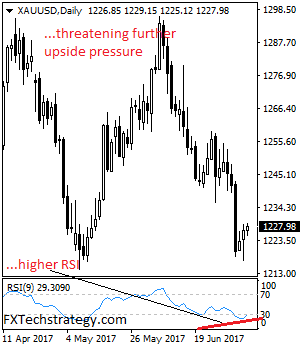

Gold: The commodity has halted its weakness and triggered a recovery higher as it looked for more correction. On the downside, support comes in at the 1,215.00 level where a break will turn attention to the 1,210.00 level. Further down,

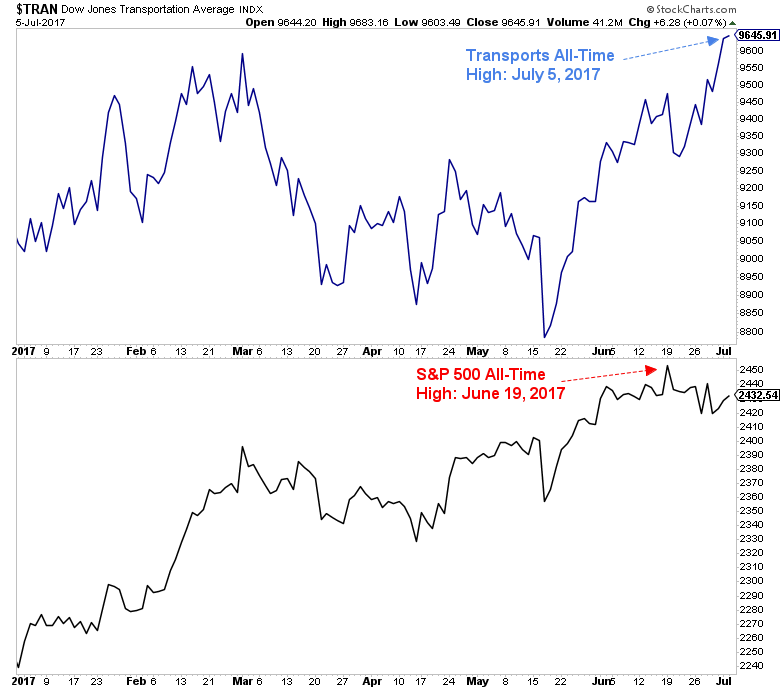

July 5, 2017